In my update last November, with our family’s move out of Brooklyn to the Hudson Valley and welcoming child #3 out of the way, I thought the next 12 months would be far less eventful. For the most part, it has been. But it also hasn’t been without some twists.

You can see all my past personal finance updates right here.

Note: All content here is for informational purposes only and do not constitute any investment advice. Please do your own due diligence and make your own investment decisions.

Note on What’s Included / Excluded

The numbers discussed in this post are basically my most liquid assets, assets that can easily be converted to cash (if not already cash) with a click of a few buttons. They include most of my brokerage accounts, bank accounts, and retirement accounts. They do not include all of my wife’s accounts, just our joint accounts. Over time, we have moved to handle most of our family finances centrally, but we still maintain our personal bank accounts separately, so cash amounts held by my wife are not reflected here nor are her retirement amounts. I’ve also excluded our three sons’ 529 plans which we contribute regularly to each month.

I’ve excluded our physical real estate holdings as well as any angel/LP investments and real estate partnership investments to keep things simpler. This snapshot also excludes the value of my stake in Barrel Holdings and any investments via Barrel Venture Partners. And this also excludes my joint brokerage account with Sei-Wook, which we’ve had for 10+ years with investments in various public companies.

Snapshot & Performance

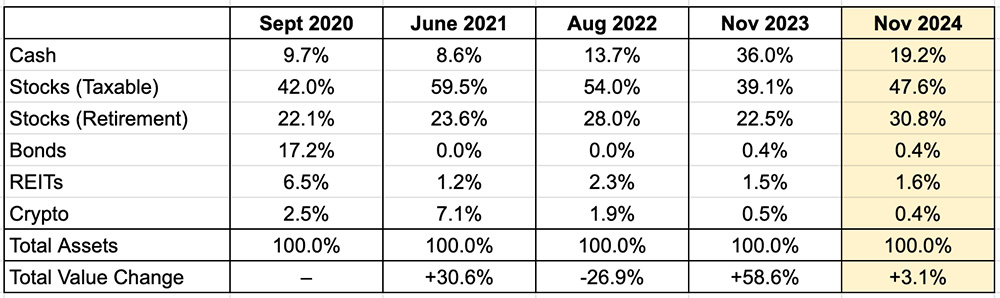

The overall value of my assets increased by 3.1% since late November 2023 (1 year). You can see the changes in allocation and the value change over the previous snapshot periods:

Note: I use Empower Personal Dashboard (disclosure: referral link) to track my holdings. I bring the numbers over to Google Sheets and also add in any other accounts that don’t connect.

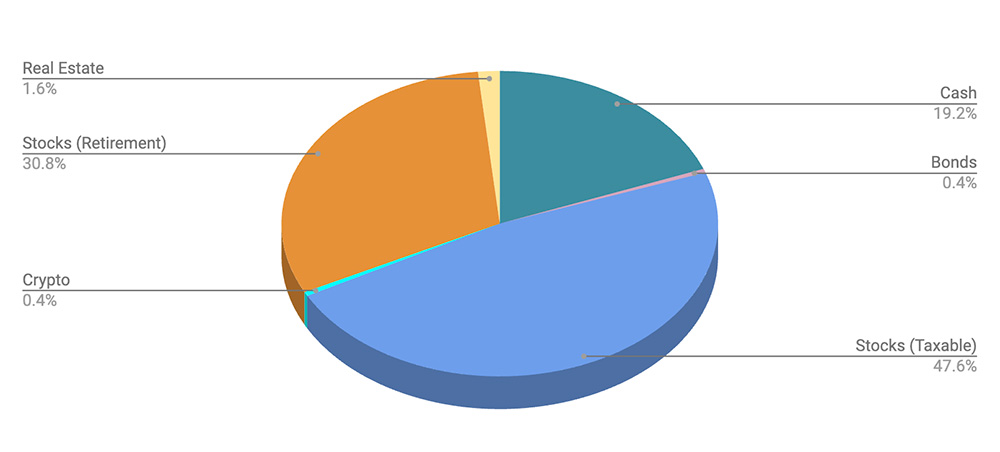

Here’s the breakdown of my assets in pie chart format. I’ve simplified the chart so that stocks also include equities-based ETFs and mutual funds. Values as of November 23, 2024:

Note: Real Estate here is for the REITs via Fundrise.

Income Source

Barrel was my primary source of income until mid-year, when Sei-Wook and I officially removed ourselves from the organization to work full-time on Barrel Holdings.

Some of Barrel’s profits now flow up to Barrel Holdings each quarter where it’s treated like the profits from the other agencies. From this pool of aggregated profits, Sei-Wook and I take a monthly distribution.

We had a quarter this year when Barrel struggled with profitability. Due to that and the timing of when we left the business, Barrel Holdings wasn’t capitalized enough to make distributions at levels that Sei-Wook and I had planned to take. It basically amounted to a few months of reduced pay, which forced us to dip into our savings to cover our personal monthly costs. Thankfully, things bounced back right away.

Huge Cash Position for Most of the Year Until…

For most of the year, I had a very heavy cash position (nearly 35% of total liquid assets). I was happy to collect the 5%+ annualized interest each month via VHPXX, the JPMorgan 100% US Treasury Securities Money Market Fund. The interest amount was wonderful to see.

But at some point, my wife Melanie and I began talking about the future, especially about moving her parents, who live in Pennsylvania, closer to us in the Hudson Valley. She began looking more seriously at real estate listings, and we agreed that if we came upon a good property, we should make a move.

She ended up finding an excellent one near the village of Rhinebeck. We moved quickly and offered all cash, closing last month.

Our investment property located about 10 minutes away from our house.

We’re hoping her parents can move to the house sometime next year. The house needs some fixing up before that happens. There’s also a downstairs unit that can be rented out immediately which will help offset the ongoing cost of owning the property (taxes, utilities, upkeep, etc.).

We’re fairly confident that at the price we paid and the location, this is an investment with limited downside. And more importantly, it’ll mean my in-laws will be super close to us, my kids being in proximity to both sets of grandparents as they grow up.

The 3.1% increase in my liquid assets that I shared above is a bit deceiving because I don’t count physical real estate properties. Had I published this post just a month earlier, the year-over-year increase would’ve been closer to 30%. Having the cash on hand made it a painless transaction although I definitely would’ve gotten a mortgage if rates had been lower. Maybe if rates come down to under 4% like the ZIRP days, it may be worth doing a cash-out refinance.

Betting On Myself and Barrel Holdings

I’m a limited partner in a handful of funds, most of them investing in early-stage startups. It’s still early in the cycle for these funds and I don’t anticipate seeing anything returned for another 4-5 years. There are just a few more capital calls left on a couple of funds, so after that, my commitment to these funds will be completed.

I really don’t see myself becoming an LP again for some time. With Barrel Holdings starting to present more and more investment opportunities – companies that we can buy or new startup agencies we can seed – I’m more interested in betting on myself.

One exercise Sei-Wook and I did was to quantify the return on BX Studio, the agency we co-founded in 2022. Given the cash flow, the dividends, and its current enterprise value (at a very conservative figure), we estimated that our initial investment is worth at least 15x in just 3 years.

We’re not going to always hit home runs. In fact, we have a few investments where we haven’t seen any meaningful returns yet. However, as we hone in our dealmaking and agency incubating chops, there will be more and more opportunities to deploy capital. Instead of committing to someone else’s fund, my thinking is that we bet on our own investments.

This line of thinking is only possible because I’ve diversified enough outside of Barrel Holdings. As long as we’re smart about protecting our downside (e.g. not being irresponsible with debt & personal guarantees, being disciplined about underwriting risk, etc.), we can take calculated bets and continue honing our skills as investors.

Insurance for Peace of Mind

I increased my life insurance by adding a $5-million 20-year term policy (I just used PolicyGenius to get a quote). I already had a $2-million 20-year term policy, so we now have $7-million in coverage for the next 15 years. I also have various life insurance via my businesses.

Over the past year, a few people I know passed away unexpectedly. They were all around my age with young children, incredibly tragic. There’s no guarantee that we’ll all live long lives.

For what it costs – a few thousand bucks a year – life insurance can be a pretty good product. It gives me some peace of mind knowing that, should something happen to me within the next 15 years, my family will at least have some financial security.

Beyond life insurance, we also recently got an umbrella insurance policy. Since we’ll become landlords by renting out the basement unit of our new property, it can’t hurt to have some extra protection. The alternative was to set up a separate LLC, but that felt like overkill for something so small.

Keeping It Simple, No FOMO, No Regrets

I mentioned last year how I drastically simplified my investing:

These days, my investing approach is dead simple: automatic withdrawals each month that go to my kids’ 529 plans, index funds, Fundrise’s REITs, and our savings account (which I then sometimes move to the VHPXX money market account).

I’ve continued to keep this up. The kids’ 529 accounts are growing nicely and I rarely check my stock portfolio anymore.

The hot stock market and the ripping of Bitcoin hasn’t interested me at all. Of course, I did the math of what my crypto holdings would’ve been had I kept it all and never sold (would’ve been enough to buy the house all cash), but I’m actually very relieved to be out of the speculation game.

I see 2024 as the first real year of Barrel Holdings, and so I’m laser-focused on building the foundations for what I believe will become a massive and life-changing business for me and Sei-Wook, our respective families, our agency leaders, and others who join us in our journey.

But it’s not really about striving for money, wealth, and high net worth. It’s about the quality of life, the joys of pursuing something exciting and interesting, of learning, working with great people, and ultimately providing security for our loved ones. Whether or not we hit some big numbers in our lifetimes, I already feel like a winner for playing this way.