I’ve told a few people that these days, working on Barrel Holdings feels a lot like the early years of Barrel (circa 2006 – 19 years ago!), especially the first 2-3 years when it was just myself and Sei-Wook. We were figuring things out and continually excited and drawn to different possibilities.

One thing I realize in hindsight is that many of our early explorations and side projects (non-client work) planted the seeds for what would come years later. I’ll share a few examples:

- Barrel to Bottles: we ran a wine review site where we bought affordable bottles, took photos, and recommended food pairings. We learned a lot about writing copy, product photography, and creating a media site.

- Awesome Creatures: we created a t-shirt brand and spun up an e-commerce website using PayPal as the checkout (this was pre-Shopify). We put a great deal of effort into brand design. This was also our first exposure to e-commerce, fulfillment, customer service, and lifestyle photography, skills that would make us more comfortable deploying ecomm solutions for clients years later.

- Brink Magazine: we helped build and maintain a friend’s literary journal, which pushed us to become more adept at configuring content management systems (we started with Textpattern but would move on to ExpressionEngine and then WordPress)

- Gobbl: we collaborated with a friend on a social network for foodies, which helped us develop UX/UI chops, web app building skills, and growth hacking tactics. These capabilities served us well in the early 2010s as we worked with many NYC startup clients.

- Reliable Teacher: we ran a review site for people interested in going to Korea to teach English, allowing them to see which schools were credible and treated their teachers well. This project exposed us to the world of data scraping, WordPress, and SEO.

All of these endeavors led nowhere commercially, but we immersed ourselves and learned so much. Looking across the Barrel Holdings portfolio of agencies today, I can’t help but notice that many of the services and capabilities seem very much like the skills we picked up in our early days.

A few years ago, I would’ve lamented that we lacked focus and distracted ourselves with so many internal side projects in those early days, but I’ve come to embrace the possibility that these types of explorations / projects were what allowed us to remain in business for as long as we have. They gave us breadth and allowed us to evolve or pivot our service offering to keep up with the times.

Thinking about the explorations and projects that Sei-Wook and I are into these days, it’ll be very interesting to see, in 10-15 years’ time, what kinds of seeds were planted. For now, we’re being open, curious, and trying a lot of different things.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

Q1 2025 Barrel Holdings Quarterly Meeting

We reviewed 2024’s numbers and shared each agency’s respective goals for 2025. Revenue across the entire holdco was flat, primarily held back by Barrel’s revenue drop (down almost 23% for the year due to client churn in early 2024). Thankfully, strong growth from BX Studio (+72%) and Bolster (+219%) made up the difference.

Profitability (EBIT) was up nearly 47%. Part of this was driven by Sei-Wook and myself exiting Barrel mid-year and no longer taking guaranteed distributions (salary equivalent). BX, Bolster, and Vaulted Oak also grew their EBIT amounts, helping drive growth.

We’re aiming to grow topline by +40% and EBIT by +85% in 2025. Lofty goals, yes, but we’re counting on: Barrel having its first topline growth year since 2021; Bolster continuing its momentum and doubling; Catalog and Prima Mode contributing more meaningfully to the totals; BX and Vaulted Oak with steady growth.

At the meeting, we had Saniya Aggarwal, co-founder and CEO of our Amazon agency Prima Mode, joining us in person for the first time. David Ries, who’s been driving a lot of account leadership and business development at Vaulted Oak joined us in person as well.

We had a brief discussion on how our agencies were using AI before I covered some topics and themes for 2025.

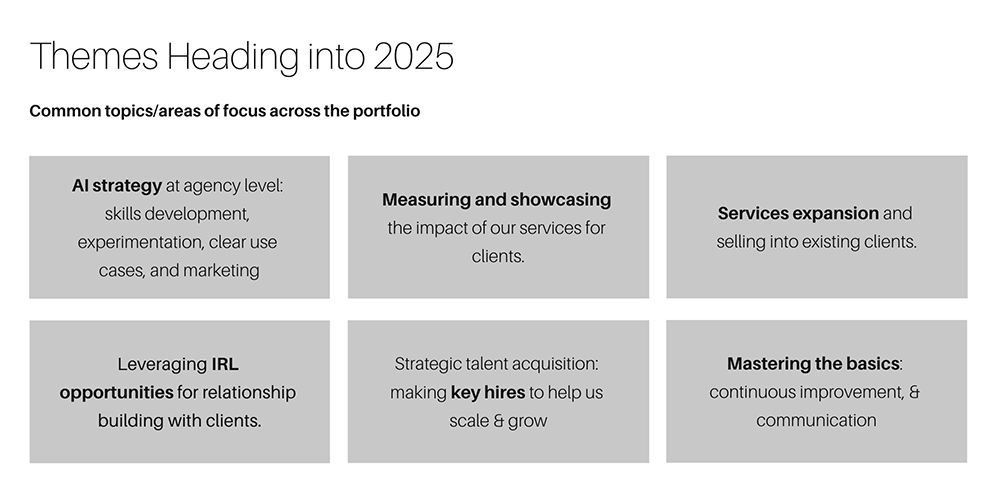

I shared these six themes for 2025 with our agency leaders.

Here’s a more detailed rundown:

- AI adoption & experimentation

- how our agencies adopt and integrate AI capabilities will continue to be an important topic

- we talked about deliberate investments in experimentation and establishing clear use cases with both internal processes & on client engagements

- we want our agencies to actively market our AI-related capabilities and case studies as we increase proficiency

- Measurement & Impact

- this is a weak spot across our agencies, the lack of clear measurable outcomes that we deliver to clients

- we’re making it a priority to better define outcomes, measure them properly, and to tell the story of the impact we deliver for clients

- Services & Account Expansion

- our most successful accounts are those where clients are buying multiple services or engaging us on multiple work streams

- we want more strategic efforts in designing our services and our account management motion to grow our existing relationships

- IRL Interactions

- all of our agencies are fully remote but we’ll look to meet many of our clients in-person throughout the year

- we’ll also invest in attending conferences and holding private events to create more IRL situations

- Key Hires

- we have various key roles open across the portfolio and each hire can have enormous impact

- our focus is not only on sourcing and vetting the best candidates but also improving our onboarding and performance management practices across all the agencies

- The Basics

- we are a broken record when it comes to mastering the basics: no agency can grow without embracing continuous improvement (get feedback, enhance processes) and being exceptional with comms (proactive, highly responsive, clear, organized); we’ll continue to sound this drum all year long

In the afternoon, the agencies took turns sharing their results and progress. Sei-Wook and I had revised the structure of these presentations, but we realized we didn’t do a good enough job in tightening up the flow. Each agency went over their allotted time while being too repetitive. The next day, Sei-Wook and I took a scalpel to the quarterly deck; next quarter’s presentations should feel a lot tighter across the board.

A couple of shared meals with our agency leaders (lunch on the left, dinner on the right).

We ended the day with a nice dinner at Café Carmellini, where BX Studio’s Director of Engagement Todd Griffin joined us. It was a wonderful dinner and I enjoyed learning about everyone’s hobbies and interests. Very excited to the year ahead with this crew.

A Few Different Investments

Towards the end of 2024, we signed engagements with a couple of consultants to help with business development across the portfolio.

I got to know Luke Maloney as he was building Deliverable, an AI startup that aimed to help agencies create better proposals and scopes. As an advisor, I spoke to Luke numerous times, sharing my POV on the agency business development process and needs. Deliverable ultimately didn’t work out, but I got to witness Luke’s skills as a sales person and get exposure to his deep B2B enterprise sales experience. When I reached out to him about possibly consulting our agencies on our sales motion, he was in the process of standing up just such a practice.

Just in the first month, Luke’s had a positive impact. He’s focusing on helping 3 of our agencies initially – Bolster, Prima Mode, and Catalog. Our agency leaders have raved about the support they’re getting from Luke, ranging from mindset conversations to very tactical feedback on recorded sales calls. Fitch, our Catalog CEO, remarked that he owed a great deal to Luke in closing a couple of recent deals after a long dry spell.

We’ll eventually get Luke to work across the entire portfolio, but it’s been a very promising start.

We’re also working with Jenny Mueller, who was previously at BigCommerce heading up their private equity partnerships initiative. We’ve engaged her to help build out a similar program at Barrel Holdings where we can build long-term partnerships with PE firms and help them connect their portfolio companies with relevant agencies in our own portfolio. We just completed designing a one-pager and will have an updated landing page in the coming weeks as we start our outreach campaign.

Lastly, Sei-Wook and I both got ChatGPT Pro accounts ($200/month each). I’ve found it to be powerful for thinking through various agency concepts as well as 3-5 year strategic plans for each agency. I’ve also used it to refine/reinvent our services offering language. I find the o1 Pro model more powerful and higher quality in its output for certain prompts, especially where I’m looking to explore different upside and downside scenarios of new agency concepts or acquisitions.

We’ve also been messing around with Operator, ChatGPT’s browser-based agent. I had Operator spin up a Google Slide presentation for an internal guide I was creating. The end product was not quite usable yet, but it was crazy to observe the agent creating each slide and inputting the appropriate text. We’ll continue to experiment and see where we can automate certain tasks.

Top of Mind

Margin of Safety and Agency Venture Studio

Warren Buffett’s idea of a margin of safety is essentially ensuring you buy an asset at a price low enough—and backed by enough intrinsic value—that even if things go worse than expected, you still likely won’t incur a permanent loss of capital.

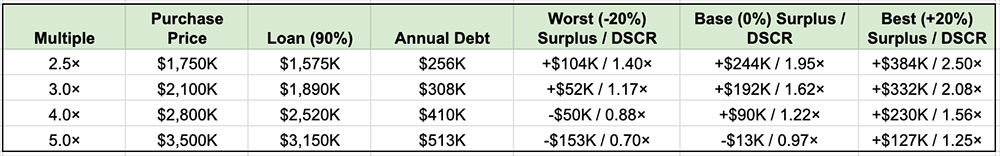

Applying the concept to agencies, this means establishing a sufficient cushion between a) what you pay for the business and b) the underlying, stable earnings that produce value in the future. We should aim to acquire agencies at prices that reflect conservative assumptions about how well the agency can maintain and grow their cash flows.

In our M&A efforts, as we’ve engaged with potential sellers, we’ve found ourselves unable to meet the prices set by the sellers and their brokers. We’ve found ourselves skeptical of most future projections and “adjusted” EBITDA figures. When we factor in debt service and the cost of a quality leader to replace the founder along with all the characteristics of the business (historic growth rate, consistency of earnings, stability of client roster, etc.), we often come up with a valuation that’s typically 30-50% lower than what sellers expect.

Now, it could be that we’re just way too conservative. Perhaps we’re too sensitive to how the sausage is made and are overindexed on how so many things can go wrong. We’re often told that other buyers have “offered at or above asking”, making us look stingy in comparison. But the prospect of taking on debt–most likely an SBA 7(a) loan–isn’t something we want to take lightly.

An oversimplified illustrative example of a $700k SDE (seller’s discretionary earnings) business and the impact of price on performance. We like to see how the agency can weather a -20% drop in earnings – can it still service the debt? If you overpay, you’ll have to absorb negative cash flow or risk defaulting, which could lead to the lender going after your personal assets/forcing you into bankruptcy. We want to bake in margin of safety and also have confidence we can execute really well.

The last thing we want is to overpay for an agency, have it struggle, and be stuck servicing the debt using cash flow from our other agencies. This would cause undue stress and also have a very high opportunity cost. I’d rather be patient and keep my eye out for the “fat pitch” that Buffett often talks about versus doing a deal just to say we bought something.

I’ve had to revisit my expectations with M&A. I thought 2-3 deals a year was something we’d be able to ramp up to in no time, but it could take longer. Perhaps we hit our stride and find the right opportunities soon, but I can also see a scenario where we go a whole year without doing a deal.

Thankfully, the action isn’t only on the M&A side. We’ve been quite busy with our agency venture studio activities, conceptualizing new agency businesses that we’d launch from scratch. After the challenging process of getting Bolster off the ground and the slow start to Prima Mode, I thought M&A was the way to go, but I’ve come back to believing that with the right positioning, business model, deal flow sources, and leadership, we can quickly create value and find ourselves with another BX Studio. It’s about the right strategy and strong execution.

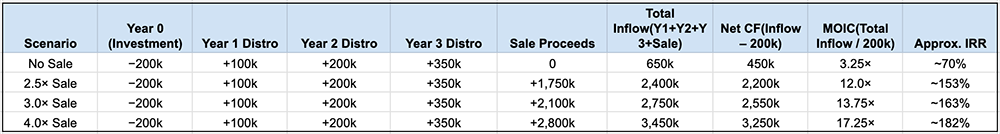

Our agency venture studio model limits downside risk by avoiding large upfront payments and debt. Instead, we invest in operations for the first 6–12 months, with funding split into two parts: a direct equity investment securing our ownership stake and a flexible capital line the agency can draw on as revenue grows and working capital needs increase.

Also, with AI and the availability of talented freelancers, there’s a case to be made that starting from scratch in these fluid and fast-changing times may be an advantage. Even a relatively small agency with 20-40 people may feel too rigid and slow-moving in certain contexts. It’ll all depend on the type of work they do and the value they bring to clients via the headcount.

Overly simplified model of how we think about new agency ventures. Assuming you successfully grow to do $100k, $350k, $700k in cash flows the first 3 years, a $200k investment can return 3x from distributing 50% of the cash flows each year. Not bad at all. And if you are able to exit the business (assuming you own 100%), that’ll really juice your multiple on invested capital (MOIC) – 12x even if you sell it at a conservative 2.5x multiple. At Barrel Holdings, we expect to hold for long term and increase MOIC through annual cash flow distributions.

It’s very possible we may have 1-2 new agency launches this year. In the meantime, we’re doing some “prototyping” runs where we’ll stand up an entity and see how it does for 6 months. If we can gain traction and land real clients, we’ll further capitalize the business and make it a real thing. If it fails even after much tweaking, we’ll drop the concept and move on to the next one.

I can see a situation down the line where we successfully launch a new agency, have it grow organically, and then over time, seek out tuck-ins and bolt-ons via acquisition to expand both capacity and capabilities. I can also see a situation where we launch an agency but ultimately acquire a bigger and more established agency that absorbs the upstart. Lots of possibilities.

And if I’m being honest with myself, there’s a great degree of comfort in the 0 to 1 (launch agencies from scratch). Of our 6 agencies, we’ve created 5 of them from scratch. It’s what we know how to do. Not all of them were immediate successes, but we feel like we’ve learned enough to know how do it better the next time.

The long-term goal is to make both M&A and our agency venture studio as predictable and programmatic as possible – repeatable processes, infrastructure, playbooks, and strong talent networks – so that we can confidently deploy ever-increasing amounts of capital in productive ways. It’s early days.

Shared Quotes

“All of the firms that have let the team decide on the KPIs discovered, usually to their pleasant surprise, the team chose KPIs that were tougher on themselves than the partners would have been. People who select their own goals are usually more demanding of themselves than when those goals are selected for them.” (Ronald J. Baker , Implementing Value Pricing)

I don’t find this to be the case with everyone, but the ideal situation is having a high performer who sets ambitious goals and backs it up with real performance. Sometimes, we get people who are very conservative in their goal-setting but exceed with strong performance. The two situations we never want to see are a) people who set weak goals and underperform anyway and b) people who set very ambitious expectations but fail to back it up with performance in a big way (it’s okay to fall short as long as you’ve given it your all and made progress).

“Our goodwill compounds when we share with others. We should act as a funnel, not a sponge. As Charlie Munger so beautifully puts it, “The best thing a human being can do is to help another human being know more.” In life, the winners also lose occasionally, but those who help others win can never lose. So always help others rise. This is how goodwill compounds over time.” (Gautam Baid, The Joys of Compounding)

I find this to be true. Writing my Agency Journey series, sending out my newsletter, posting on LinkedIn, publishing on AgencyHabits, and getting on calls with agency founders – these all seem to have built up some goodwill over time.

“M&A requires a set of capabilities that are built over time, as a result of practice. Companies that execute programmatic M&A over years, often decades, become true masters of the art of identifying, negotiating, and integrating acquisitions. Companies that do very few deals struggle to execute well the few they do. Practice makes perfect—the adage holds. Our research has shown that infrequent, large deals tend to hurt value creation.” (Chris Bradley, Martin Hirt, Sven Smit, Strategy Beyond the Hockey Stick)

I mentioned above that I wouldn’t be surprised if we did very few (or zero) M&A deals this year, but that doesn’t mean we won’t be fully engaged in M&A activities. We’re going to continue sourcing, continue talking to potential sellers, and making offers where it makes sense. Long-term, I can see us getting better and better at this and eventually having that “programmatic” M&A capability.