In early October, we relaunched AgencyDocs as AgencyHabits, a resource for agency operators drawing from the learnings at across our businesses at Barrel Holdings.

The reception has been positive and we’ve managed to grow the email list since going live. We’ve posted over a dozen articles and began sending out a weekly email. The goal is to replace the downloadable templates and SOPs currently on AgencyDocs with a tighter and more updated version by the start of the new year.

The main point of AgencyHabits is to generate two types of leads: potential acquisition targets and potential agency leaders. By sharing what we’re up to at Barrel Holdings and also providing a lot of value through our content and products, we want to be top of mind when agency owners think about selling or want to recommend talented people.

We want AgencyHabits to generate enough revenue to support itself. Right now, we’re working off of some savings accumulated from past AgencyDocs sales. If AgencyHabits can generate revenue through its own products and potential sponsorships, we can reinvest more into the business and increase the footprint. Perhaps we’ll even be able to hire a general manager so I don’t have to be the one doing all the heavy lifting! Till then, lots to do.

About Agency Journey: This is a monthly series detailing the happenings at our Barrel Holdings agencies. You can find previous episodes here.

Highlights

Attending BubbleCon

I was invited to be a speaker at BubbleCon in New York City. I shared the stage with Andrew Haller, co-founder of Airdev, the world’s leading Bubble development agency. To an audience of mostly Bubble dev agency founders, Andrew and I shared our respective agency founding stories and chatted about navigating the challenges of building and growing our businesses (watch full video on YouTube).

Took the stage at BubbleCon with AirDev’s Andrew Haller. Photo credit: Théo Goldberg

I got to meet and reconnect with a number of Bubble agency owners and enjoyed learning more about the Bubble ecosystem. There’s been strong growth and adoption in recent years. It seemed like some were a bit apprehensive about how AI might impact the low/no-code nature of Bubble and also about Bubble’s ability to position itself as a tool beyond building MVPs for startups. It’s still early days for the platform, and I’m very curious to see how they make inroads with mid-market and enterprise customers.

Big props to Théo Goldberg who leads agency partnerships at Bubble. He’s been incredibly resourceful and helpful in teaching me about the Bubble ecosystem and facilitating connections with Bubble agency owners.

I think there will be opportunities for some of our agencies, namely BX Studio and Catalog, to collaborate with various Bubble agencies.

Q4 2024 Barrel Holdings Quarterly Meeting

We held the first ever all-day session for our Barrel Holdings Quarterly Meeting. These used to be just a few hours long but now that Sei-Wook and I are full-time on the holdco and we have a few more agency leaders, we felt the time was right for a new format.

Our Barrel Holdings Quarterly Meeting included a mix of in-person and virtual attendees. Hopefully in 2025 we’ll be able to get 100% in-person at least once.

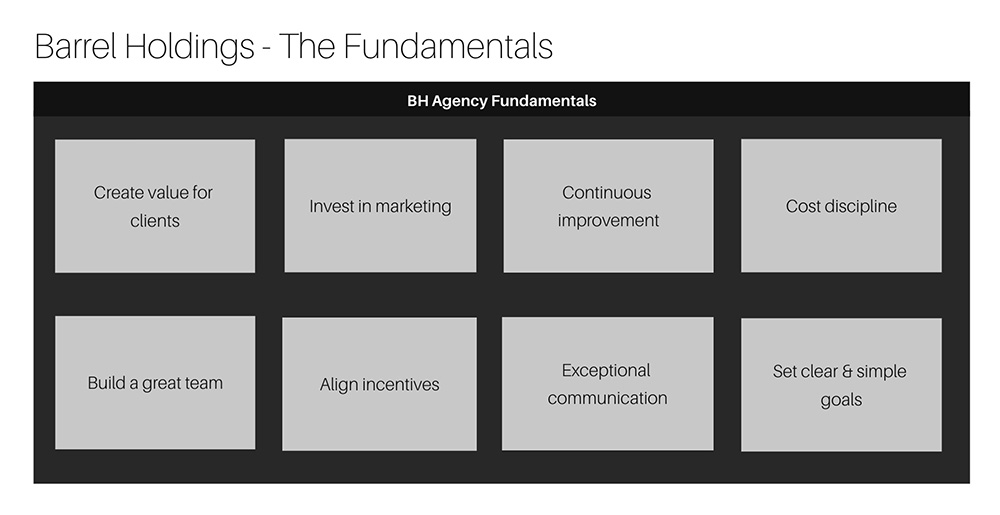

I kicked off the day by sharing some high level growth goals for the holding company including the M&A goals we have for the next 3 years. I also shared what we term Barrel Holdings Agency Fundamentals and how the success of each agency would very much be a function of executing on these fundamentals.

We walked through each of the Barrel Holdings Agency Fundamentals building blocks – nothing new but helpful to see clearly laid out.

Sei-Wook reprised his talk given to a private equity audience just weeks before, sharing insights on digital marketing trends and how he structured his presentation intended for a group of marketing execs.

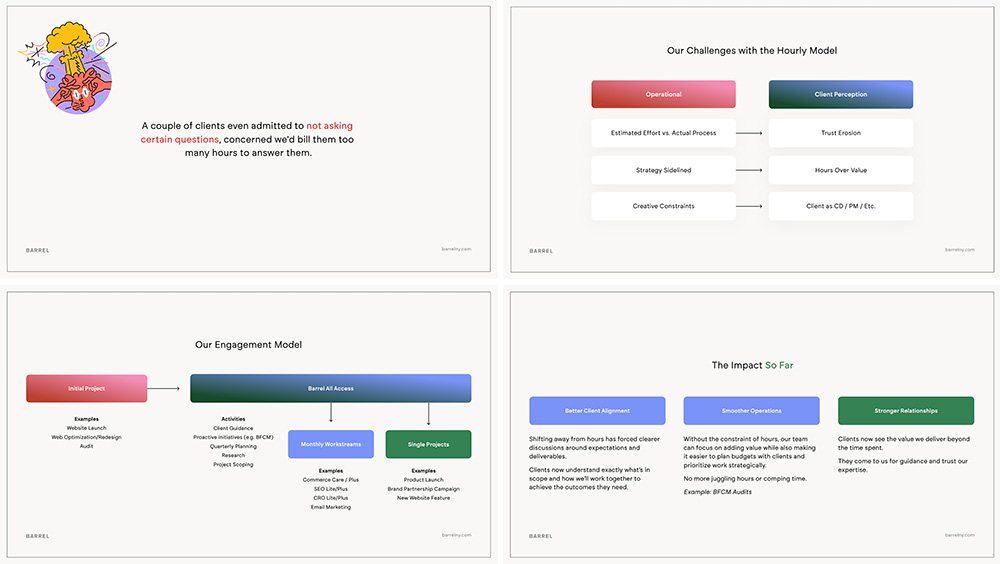

Lucas shared a very insightful presentation on Barrel’s transition from selling hours to rethinking how we structure client relationships. The results that he and the Barrel team have achieved in just a quarter has been tremendous. Relationships that were strained and on the brink of churn have been completely turned around thanks to the new approach.

A few slides from Lucas’s very compelling presentation about Barrel’s shift from hourly to fixed-fee scopes with an emphasis on delivering value to clients.

Jason Fan of Vaulted Oak gave us a peek into how he’s been able to maintain and grow such deep client relationships over the years. He shared instances where a successful client engagement netted him half a dozen new clients in subsequent years, a testament to developing trust and long-lasting relationship.

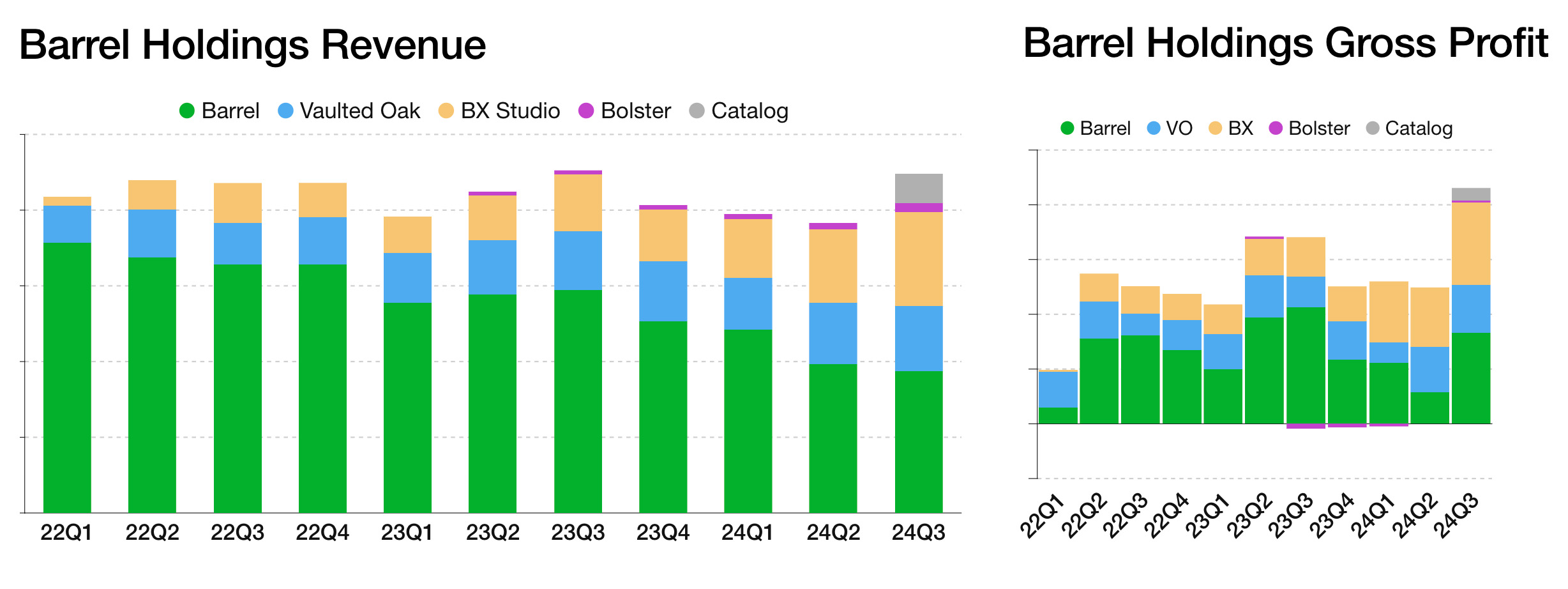

Thanks to record-breaking performances from BX Studio and Vaulted Oak, we posted excellent Q3 numbers.

As a group, we celebrated a strong quarter led by record-breaking revenue and profit performance from Vaulted Oak and BX Studio. Barrel, which struggled in Q2, bounced back nicely in Q3, posting much improved profit numbers even though revenue remained flat. Bolster also posted its best numbers ever and should have an even better Q4.

We capped off a long day with some Korean BBQ and whiskey.

Henry Alcock-White, co-founder and Creative Director of Bolster, was able to fly out from Vancouver Island and come out to New York City for the first time. It was great to finally meet him in person after nearly two years of working together on Bolster. We all went out and enjoyed Korean BBQ together afterwards.

Top of Mind

Agency Sales and Marketing: How Much to Invest

What’s the right amount to invest in sales and marketing across our agencies?

This is a question we’ve been asking ourselves and digging deeper into.

We chose Barrel as a starting point since it’s the largest agency in our portfolio. We hadn’t been as discerning in separating out sales & marketing activities from COGS, lumping all people costs with COGS unless someone was clearly 100% not billable.

We went back and reviewed time tracking data to come away with some new numbers, shifting dollars away from COGS and into sales and marketing. Our discipline leads and account managers experienced the most meaningful changes, as 20-25% of their time could be reallocated mostly to sales (new biz and account growth activities).

We also had to define our marketing activities more specifically, going beyond the obvious sponsorships, outbound, and paid spend to also include internal hours spent on our agency website, newsletter, case studies, and social posts.

After playing around with the numbers, a picture started to emerge. Gross profit margins were predictably higher since we moved costs out of COGS. We also saw that sales costs were pretty significant (nearly 13% of revenue) since it involved our highest paid personnel. Marketing, relative to sales, was low, coming in at under 4% of revenue.

From this exercise, we started to build a simple strategic financial model to help think about sales and marketing investment. What we agreed on, after looking at Barrel’s numbers and the numbers across our agencies in the portfolio, was that gross profit needed to land close to 55%. Hitting this number means the team is most likely operating very efficiently and/or supported by favorably priced engagements. It then provides more dollars to invest in sales and marketing.

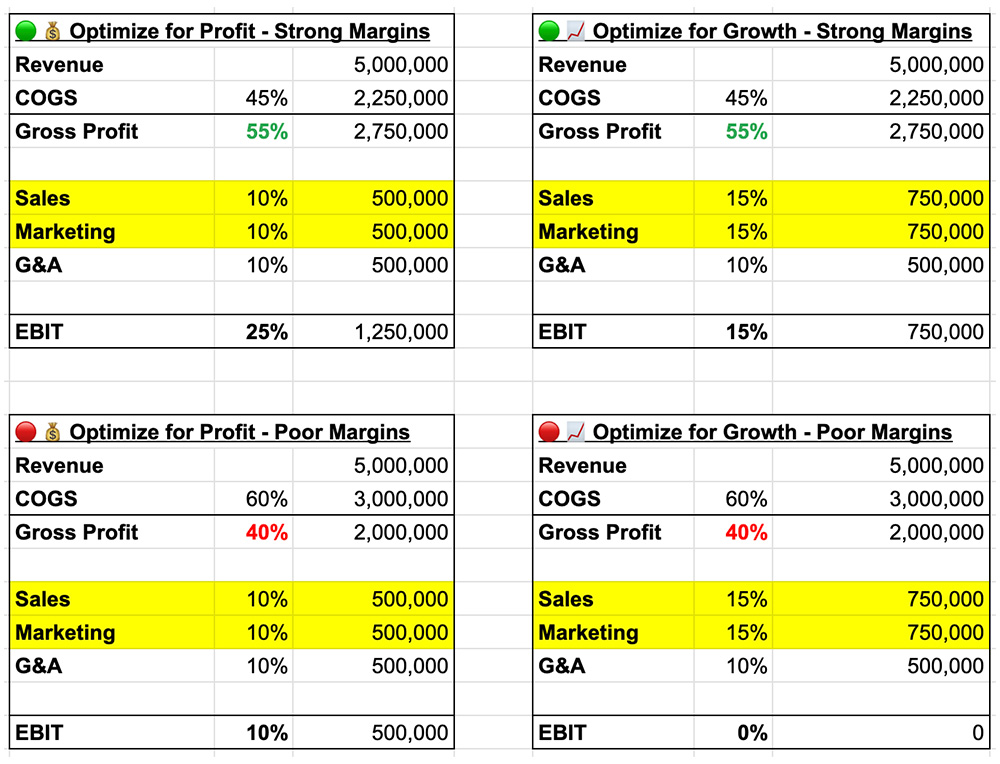

As you can see in the examples above, at 55% gross profit margin, you can allocate 10% each to sales and marketing and still come away with a robust 25% in earnings, a great level to hit for an agency business. If you’re focused on growth and want to dial up sales and marketing, you can bump each 5% and still get to 15% EBIT. I think in Barrel’s case, the 13% spent on sales is a bit high given where revenues are right now, but as revenue recovers (we lost some key accounts earlier in the year), the number should get closer to 10%.

If your COGS start to creep up and your gross profit margins start to shrink, then you can see how difficult it is to maintain sales and marketing spend. Greg Crabtree in his book Simple Numbers, Straight Talk, Big Profits! talks about how 10% pre-tax profits (earnings before tax but after interest and depreciation in has case, less applicable for agencies) is essentially breakeven:

After we looked at breakeven analyses, we concluded that when your pretax profit is at or below 5 percent of revenue, your business is on life support. At that point, you’ve got to do something drastic. When it comes to pretax profit, here’s what I’ve found to be true for the vast majority of businesses:

- 5 percent or less of pretax profit means your business is on life support.

- 10 percent of pretax profit means you have a good business.

- 15 percent or more of pretax profit means you have a great business.

If you’re above 15 percent, you better take it while you can because the market will eventually change. The best businesses tend to operate between 10 percent and 15 percent.

Going through this exercise helps us get a sense of where our baseline should be. From here, it’s about making some decisions on how we want to invest in sales and marketing. Are the current investments and activities effective or just a cost center? Are there new channels, activities, and personnel that can help us achieve better results?

Coming back to Barrel as an example, we determined a couple of things:

- We have a fairly robust infrastructure for sales (very involved leadership team + account managers) – we don’t need to invest additional dollars but will let things play out for another couple of quarters to allow our team to grow existing accounts and land new ones.

- We felt that we underinvested in marketing (at just 4% of revenue) and could be much more strategic. With Barrel’s positioning solidifying more into CPG commerce, we think there are some great opportunities to invest in activities (events, content, outbound emails, and paid ads) that focus more on our refined target audience.

The way we see it, the goal of marketing for our agencies is to drive the right kinds of opportunities. The goal of sales is to take those opportunities and convert them into wins. These two are tightly linked because if you can dial in marketing and bring in high quality opportunities that match our ideal client profile, it’ll be much easier for sales to close these deals at a higher rate.

We want to absolutely avoid a situation where the opportunities are few and far in-between while the prospect types are all over the map. This inevitably forces the sales team to scramble and try desperately to position ourselves as a good fit when that’s clearly not the case, leading to lower win rates.

Across the holding company, if we apply this exercise and look and sales & marketing spend, I think we’ll see a trend of underinvestment in marketing and perhaps too much of revenue going to sales. In some cases, we may be taking out too much profits in the short term and may be better served by being a bit more aggressive on marketing spend.

Of course, spending more money doesn’t mean we’ll necessarily get the results. We’ll need to be disciplined across all of our agencies in how we allocate budget, measure results, and continue to experiment until we find activities that can predictably generate more opportunities.

Shared Quotes

“There are only two types of turnaround: (1) income statement turnarounds or (2) balance sheet turnarounds. Both necessitate positive cash flow. The former involves running out of cash from losses and about to stall mid‐flight. The latter may involve a stabilized business with suffocating levels of debt.” (Jeff Sands, Corporate Turnaround Artistry)

This is a helpful lens through which to look at struggling businesses. When you boil it all down, a struggling business is one that doesn’t generate enough cash flow. Knowing what type of turnaround situation they are in helps to lay out potential paths to stabilizing the business. With Catalog, it was a bit of an income statement turnaround but we were able to act fast and reverse the negative cash flow within a month.

“MATURITY is the ability to live fully and equally in multiple contexts, most especially the ability, despite our many griefs and losses, to courageously inhabit the past, the present and the future all at once. The wisdom that comes from maturity is recognised through a disciplined refusal to choose between or isolate three powerful dynamics that form human identity: what has happened, what only looks as if it is happening now, and what is about to occur.” (David Whyte, Consolations)

I’m not sure this excerpt would’ve resonated even just a few years ago, but the “ability to live fully and equally in multiple contexts” is something I feel more acutely as I grow older.