What a year it’s been. Last December, I was still very much in the weeds of Barrel’s day-to-day, fretting about our various client accounts, the agency’s positioning, and how we were going to ramp up our sales and marketing efforts.

Mid-year, Barrel’s new CEO Lucas Ballasy took the helm and he’s been fully in control of the agency that Sei-Wook and I founded 18.5 years ago. Lucas has been doing a wonderful job (more on that below) and that’s allowed me and Sei-Wook to focus on building Barrel Holdings, our portfolio of agency businesses which grew to 6 agencies in 2024.

It’s been a wild year filled with transitions, new responsibilities, new learnings, and new goals. One bit of feedback I have for myself after a rather exciting past 6 months: settle down, focus on a couple of priorities at a time, and do them well.

We’ve got the beginnings of something very special at Barrel Holdings, and it’s our duty to ensure that everyone involved is executing at a high and consistent level. I’m very excited for the new year.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

Strong Signs for Barrel Heading into 2025

Barrel’s Q4 was strong by every measure. Revenue was up 20% quarter-over-quarter and profit was up 50%, a nice recovery from a very soft Q3. More importantly, new business bookings were way up. We exceeded our goal for new logo booked revenue and came very close to our goal for existing client booked revenue (a couple contracts out for signatures could end up exceeding the goal). Overall, lots of positive activity that sets us up for a robust start to 2025.

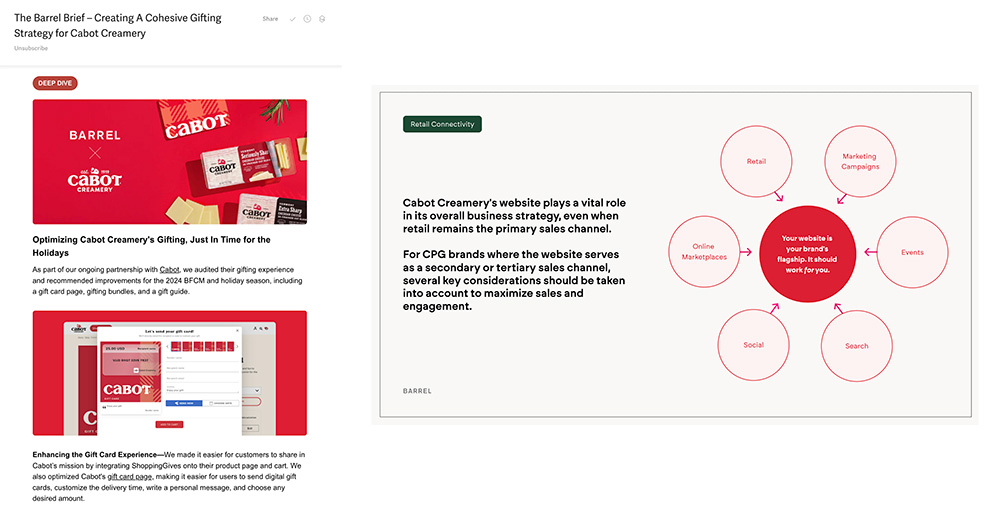

Barrel’s CPG positioning has been an important driver for the business, pushing us to go deeper in how we support our clients. We’ve been able to expand our scopes & services for clients like Cabot Creamery.

One setback is the upcoming departure of our Director of Client Services Kate Fulks. After four years, she’s moving on. She’s done a tremendous job of building up our account management discipline and helping retain and grow some of our most important client accounts. We’ll miss her.

Barrel’s CEO Lucas was obviously disappointed to see Kate go but he acted fast, making a key replacement hire that we’ll be sharing in the coming weeks. He’s also done a great job of leveraging seasoned contractors in areas like SEO, CRO, email, and content production to ensure that Barrel can offer a broader range of services for our CPG clients.

Sei-Wook and I couldn’t be more impressed with how Lucas has fully embraced the role of Barrel CEO. His leadership skills have only become more evident in the way he’s navigated setbacks with clients and team members. He’s been a clear communicator, a brilliant strategist, and a very astute business manager, keeping tight rein on costs while finding ways to grow revenue.

It’ll be Year 12 for Lucas at Barrel but from the energy and sense of possibility he brings to the role, it feels like Day 1.

Prima Mode’s Slow Start & Refined Positioning

It’s been about five months since we officially launched Prima Mode, our Amazon agency. It’s been a slow start on the client acquisition side.

We overestimated our ability to cross-sell through Barrel and Vaulted Oak. Our initial thought was that we could quickly refer a handful of clients that needed Amazon help over to Prima Mode. We were able to set up some introductory calls, but we failed to sign anything early on.

Prima Mode co-founder Saniya Aggarwal kept on grinding, creating and posting thought leadership content on LinkedIn, sending outbound messages, and attending events to meet founders. Through her efforts, Prima Mode has a small base of clients, and we’ll soon have some case studies to support our marketing campaigns.

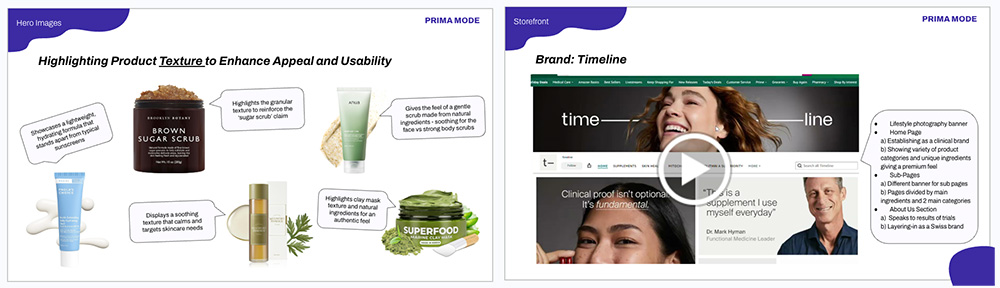

We launched an e-book as a lead magnet on LinkedIn to build awareness around Prima Mode’s health & beauty focus.

We also decided to refine our positioning and get more specific about our ICP. Rather than casting a broad net of any business that needs Amazon help, we’re going specifically after health and beauty brands. These are companies that sell supplements, skincare products, cosmetics, etc. And within these, we are targeting brands that are very new to Amazon or have not yet started selling on Amazon. This will usually mean brands that are emerging and fairly early stage, but some will be ones with a strong direct-to-consumer and/or brick-and-mortar channel that haven’t yet fully embraced Amazon.

We’ve got some outbound campaigns queued up to start in early 2025. We’ll also look to network more heavily with CPG accelerators, investors, and founder communities to connect with brands that could use Prima Mode’s guidance on properly setting up to sell profitably on Amazon.

Catalog’s Struggles & Experiments

Our product design agency Catalog logged its first negative cash flow month in December. The cause was a big drop in revenue as several clients discontinued their month-to-month engagements with us.

We’ve haven’t yet cracked the lead gen challenge – there’s been very minimal inbound deal flow and our outbound efforts have been slow to materialize. The one bright spot has been a recent campaign led by Catalog’s CEO Fitch Li to offer free UX Audits to startups. We’ve gotten a handful of bites and may even convert one into a client.

There’s only so much more we can cut cost-wise, so we’re really at a cross-roads: find a way back to breakeven/positive or shut it down.

A best-case scenario I see for Catalog in the next month is something like this:

- We retain most of the clients from this month to the next

- We add a couple of new clients, who sign up for 3-month engagements

- We launch an outbound campaign that brings in additional deal flow

- We tighten our sales pitch (we’ve hired a sales consultant to work with Fitch) to win a higher % of deals

- We start to see a pipeline with at least a half dozen qualified opportunities take shape

If a stronger pipeline starts to materialize and keep growing, then I think we can tolerate a few breakeven or slightly negative months. But if we find ourselves in the same place a month from now, then we’ll have some difficult decisions to make.

Top of Mind

Further Refining the Barrel Holdings Vision

During the holiday break, I took some time to reflect on the Barrel Holdings activities of the past six months. We made a great deal of progress getting more familiar with the M&A process, and we also set up new systems and processes for the holdco and how we support our agencies.

But one thing that kept nagging at me was a lack of clarity in how we were going about with building Barrel Holdings. Our M&A targeting has been fairly broad and not too strategic, more opportunistic, which could be another way of saying “taking what we can get”. We’ve also tossed around ideas for new agencies while not quite having stabilized a couple of our existing agencies. And there’s the feeling that we’re not doing enough to build up AgencyHabits, our media property geared towards agency owners.

Basically, it’s a case of having too many options and not being focused enough.

So, I decided to revisit our Barrel Holdings Overview deck that I’ve been tweaking over the years and went much deeper into thinking about the business we want to create for the future.

One realization I had was that I was too caught up with trying to emulate the private equity game. With our M&A activities in recent months, I had become enamored with the idea of using an SBA 7a loan to buy a sizable agency business (perhaps putting only 10% down of our own cash), and then quickly scaling the business through subsequent acquisitions before flipping it to a private equity firm or a strategic buyer. It all sounded good on paper and our models looked great. 10x on our invested capital in just five years–amazing, right?

And in order to do this, it meant dedicating large swaths of time and energy to doing deals. And the more deals we can do, the quicker we can see success.

But the more I thought about our strengths and the potential downsides, the more I found myself asking: “Does it have to be this way?” Of the six agencies in our portfolio, the three strongest are ones that we built up from scratch. And these all have much more room to grow with the right support and leadership.

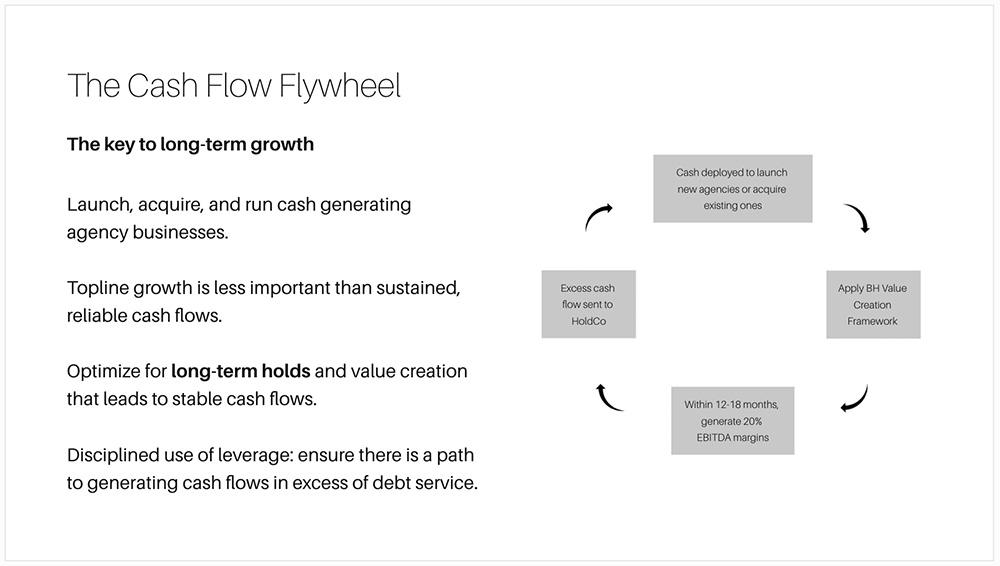

Instead of banking on some kind of lucrative exit via a sale of an agency, I found myself going back to the original vision of Barrel Holdings: a long-term holding company with healthy cash flows from the portfolio that enables growth through reinvestment, acquisitions, and new agency launches.

The key, I remembered, is healthy cash flows. The goal isn’t to exit our agencies, but to make them so valuable that we’d rather keep them and only sell because we’ve received an eye-popping offer. Whether or not an exit happened, the cash flows themselves should provide our agency leaders and teams with motivating compensation amounts year in and year out.

This slide underscores the importance of building Barrel Holdings to be a cash flow machine.

With this in mind, the long-term vision came about more naturally:

- A five-year target and how we’ll get there – add 7 more agencies, 3x organic growth for our existing portfolio

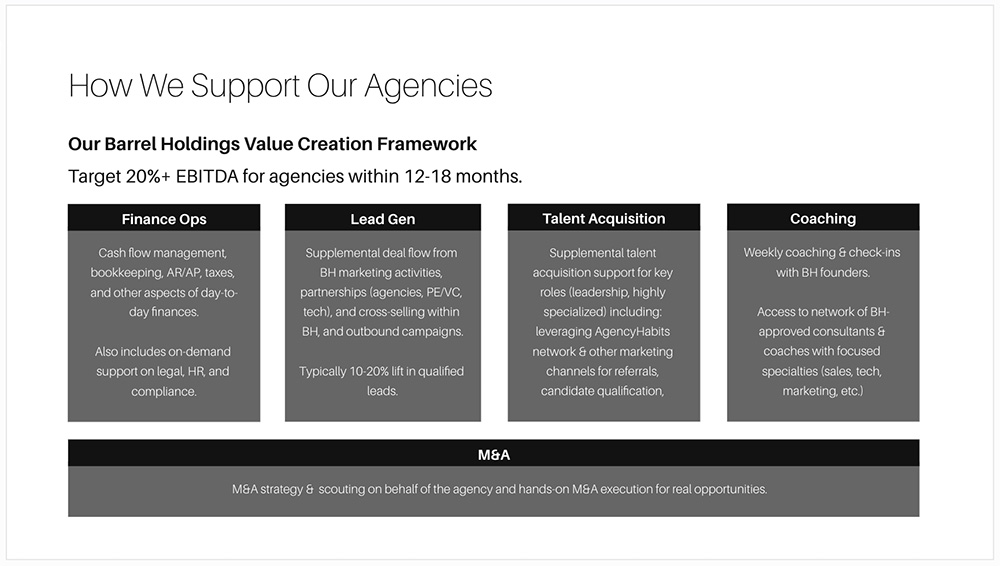

- Invest more heavily in our value creation framework, helping our agencies scale up, get to 20%+ EBITDA on a consistent basis, and build strong teams through shared services, coaching, and agency collaboration across the portfolio.

If you’re curious about how we help our agencies at the holdco level, here’s the overview.

- Have a clearer acquisition strategy, prioritizing agencies with niche focuses (vertical, platform, services) with strong cash flow potential purchased at low multiples (2-3x EBITDA). Cross-selling potential with our portcos is very important. A streamlined integration plan to apply our value creation framework, starting with the first 100 days, and then over the next 12-18 months.

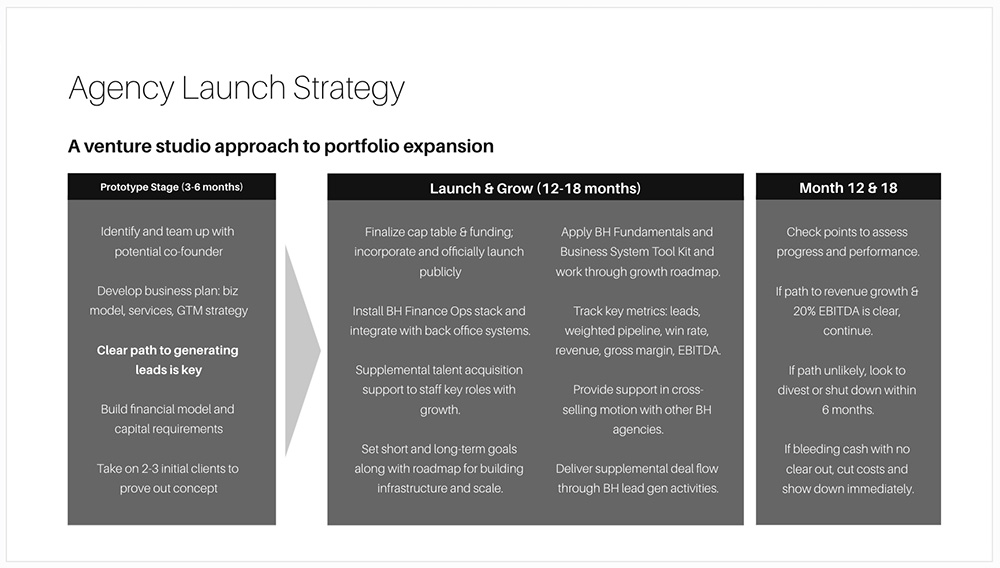

- A more robust agency venture studio model for launching new agency businesses – more upfront work on identifying opportunities and studying markets along with a streamlined approach to prototyping, launching, and evaluating the agency. Introducing clear checkpoints to assess progress and to force a “keep going” or “shut down” decision based on data.

We’ve got a lot more work to do in order to codify the agency creation process, but laying it out like this was helpful.

- Guidelines on when to divest – writing down the point at which we would entertain an acquisition for any of our agencies (7x EBITDA and up) or when we would look to proactively sell (changing market conditions, portfolio strategy considerations, leadership departures, etc.).

- Incentive structure for agency leaders, reflecting what we have in place now and what could materialize in the future to align everyone to the overall growth of Barrel Holdings, not just the individual portcos.

Throughout the process of putting these slides together, I used ChatGPT (upgraded to Pro at $200/month for the extra firepower) to map out different 5 and 15 year scenarios ranging from “Doomsday” to “Spectacular” outcomes. I fed it all the context, the vision, and the different strategies for growth.

It was incredibly helpful to read the wide range of outcomes. The Doomsday scenario, in which we experience negative growth, are saddled with debt, and are forced to sell of our best assets at fire sale prices was a sobering read. Failing to execute, being too hasty and reckless with acquisitions, and being indecisive during downturns – these were great reminders that just because you have a vision doesn’t mean success is guaranteed.

The other takeaway was that time is our friend. If we can avoid catastrophic mistakes and steadily compound our cash flows over the next 5, 10, 15 years, even the Poor and Moderate outcomes will be okay. A couple of good moves on top of that can lead to a Strong outcome, which would be anything beyond what we dreamed of when we started down this holdco path.

The mantra heading into 2025: stay focused, be patient, don’t try to do too much, and keep going.

Shared Quotes

“When you’re trying to accomplish something challenging or difficult that you’ve never done before, you probably need a Who. Let me say that another way: You absolutely need a Who if you’re trying to accomplish something new and challenging, unless you’re fine not getting the result you want in the near future.” (Dan Sullivan and Benjamin Hardy, Who Not How)

I realized that I wasn’t doing the best job of providing our agency leaders with hands-on coaching around sales and lead gen. We decided to engage Luke Maloney, who recently shut down his startup Deliverable, to help coach some of our agency leaders on sales. Luke’s a B2B sales veteran and was actually a Bolster client, so I’m excited to see how he can help our teams level up. We also engaged a firm to help Prima Mode with outbound campaigns leveraging Clay. If it works out, we’ll try with the other agencies. We’ll be looking for more resources/coaches/consultants across operations, account growth, and other areas as we invest in supporting our agencies.

“Problems are an asset—not something to avoid but something to run toward. Big ambitions often beget even bigger problems. If your initial reaction to a major setback is overwhelming frustration, that’s understandable, but it’s also counterproductive. Once you’re over that moment, pivot toward success: “Great! This is an opportunity for me to create a lot of value. If I can just figure out how to solve this problem, I’ll be much closer to my goal.”” (Brad Jacobs, How to Make a Few Billion Dollars)

This is a helpful mindset to have when trying to do anything worthwhile in business.

“Insolvency is defined as either cash‐flow insolvency, when you can’t, or don’t, foresee the ability to pay your bills on time.” (Jeff Sands, Corporate Turnaround Artistry)

I still remember a few moments in my career when Barrel was very close to insolvency. It’s a feeling I never want to forget because it’s also a feeling I never want any of our agencies to experience. We’ll do whatever we can to foresee and prevent ourselves from getting into such a situation.

Thanks for posting these, Peter! Always insightful to read.