We’re slowly working through a rebranding for Barrel Holdings. Bolster is helping us with our new look. Currently, it’s just a simple Google font with black text on white background. My presentation decks are made using an out-of-the-box minimalist template.

We figured that since we’re always talking to a lot of creative/design-focused agency owners and also have some very design-forward agencies in our portfolio, we ought to represent ourselves with a more put-together look.

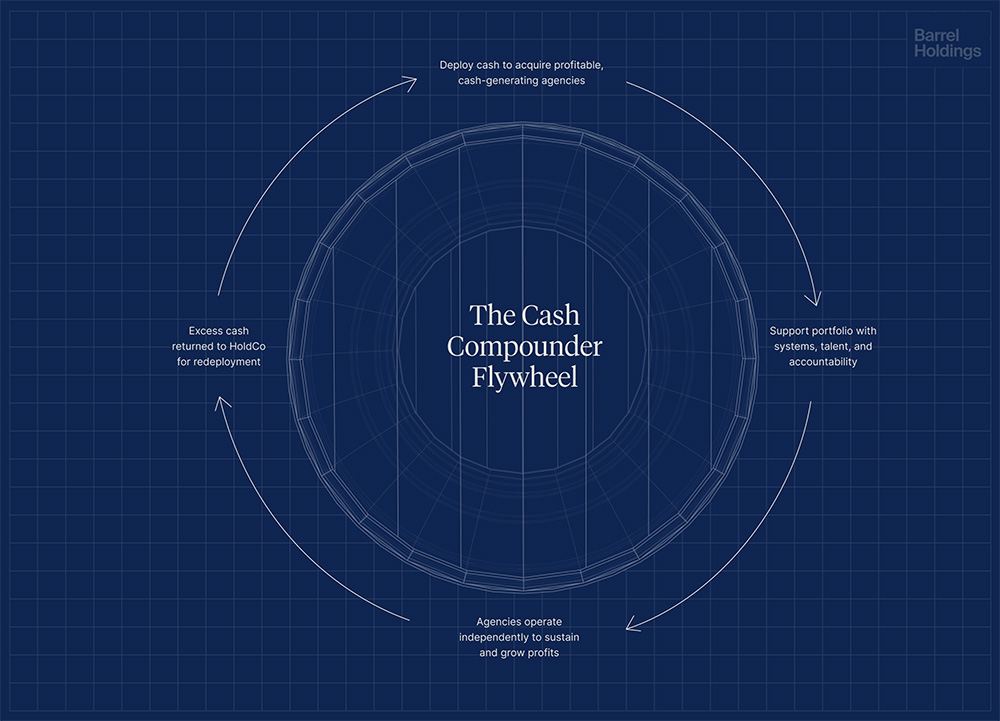

Here’s a sneak peek, a diagram that illustrates our long-term business model:

This diagram illustrates a key part of the Barrel Holdings business model and our long-term focus.

The branding project has also been a good excuse to revisit and update all the language in our decks and website. We’ve refined our strategy and business model quite a bit even in the past quarter, so we’ve revised our various materials to reflect the shift. I discuss some of this in Top of Mind, specifically pertaining to M&A.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

Navigating Margins vs. Client Satisfaction at Bolster

Our design studio Bolster has been experiencing some growing pains as it takes on more clients and expands its team.

Bolster’s budgets for brand design work is very competitive, which is helpful for winning but constraining when it comes to being able to staff it with experienced designers. Our Creative Director Henry has been testing different designers to ease his oversight responsibilities, but most of them haven’t worked out, pushing the burden back on Henry, and in turn, leading to some delays.

The tight budgets also mean we can’t staff every project with a proper project manager. Henry and our Studio Manager Quetta have taken on some PM duties as well, which isn’t ideal. Their bandwidth already constrained (Quetta leads business development), their part-time PMing often results in slower communications and missed deadlines with clients, eroding trust.

We’ve explored increasing budgets and refining our qualification process, but that’s just the start. The team has work to do in streamlining project management across all projects, improving client comms, and being more proactive in dictating the structure of an engagement (vs. letting the client dictate it or going with the flow).

I know in due time the Bolster team will work these things out, but one thing I’ve reiterated to them is that we cannot afford to give clients a subpar experience. That means I’d rather accept with low-to-negative margins on projects than doing something profitably while leaving the client less than satisfied with our service.

It’s already hard and expensive to land a new client. Turning them into a detractor who goes out of their way to tell others not to work with your agency is deadly. But this can easily happen if we’re slow to respond, miss deadlines, and get overly strict on SOW language when they’re not happy with the results. If you knew you had a detractor and you could pay money to turn them into an advocate, what would you pay? For us, it’d probably be thousands of dollars.

Of course, we’d be in trouble if every engagement was poorly priced and required us to operate at razor-thin margins. But if we’ve already gone through with starting such an engagement, we’re better served by doing what it takes to offer a great experience versus trying to eke out some short-term profit.

If you’ve established a great relationship with the client through your excellent service, you can always charge more the next time. If the client balks or doesn’t move forward, that’s okay. They can still be an advocate, or at the least, they won’t say anything bad about you.

An agency’s core momentum comes from being able to cultivate satisfied customers. Without this, there’s no amount of sales and marketing magic that can sustain a business. Happy customers that come back for more, say nice things about you, and refer you business are an agency’s most important growth driver.

Deal Flow Via LinkedIn

I’ve been fairly consistent on LinkedIn for nearly 2 years now, posting 3-5 times per week. It’s been an immensely helpful channel for meeting new people and driving opportunities for Barrel Holdings and our agencies.

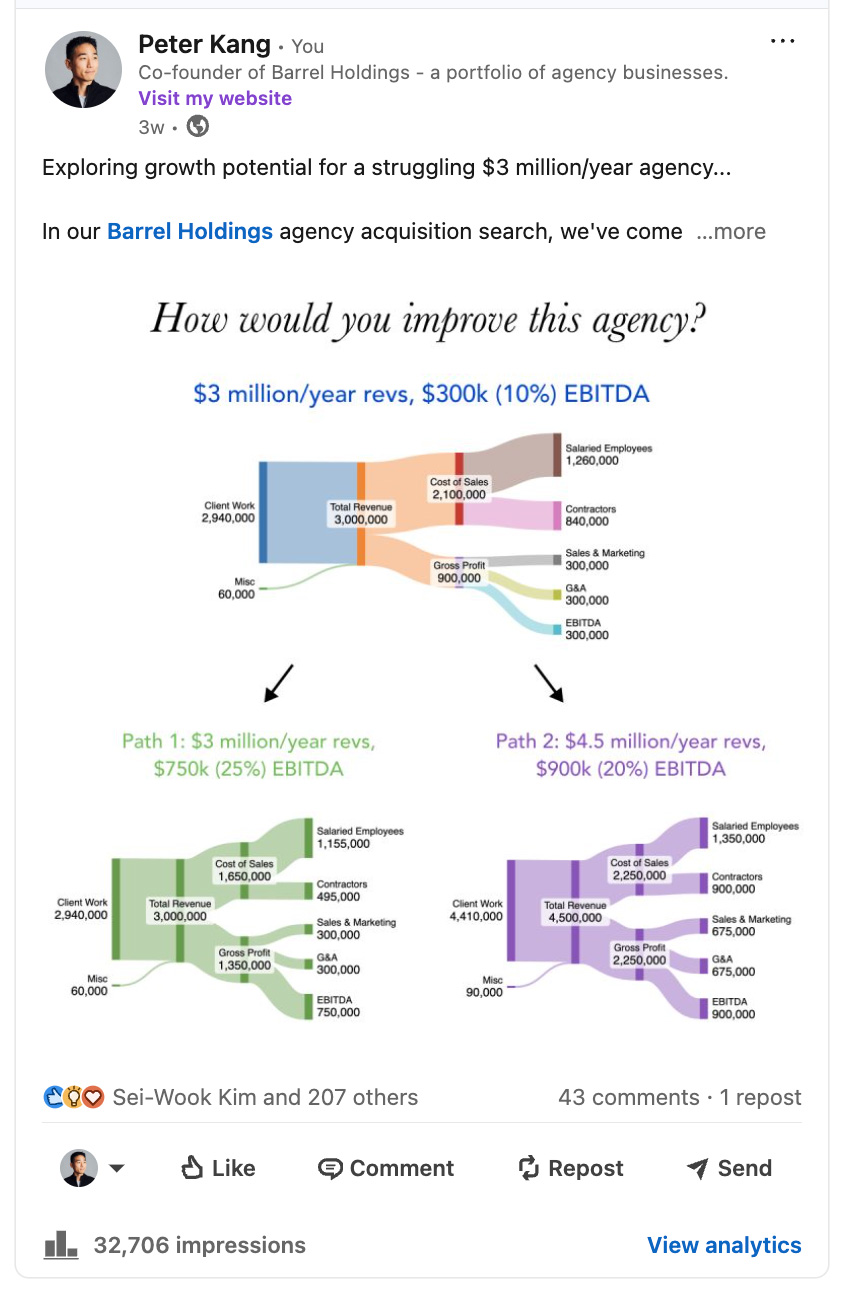

I published a post comparing two different $3 million/year agencies accompanied by colorful Sankey diagrams. The post attracted over 30,000 impressions and 200+ likes, which is 10x my usual piece of content. I think the post worked because it was a bit of a Rorschach test for agency people – they projected their own lived experiences and perspectives onto the scenario even as I purposely omitted some key context.

Was it the topic? The hook? Or the colorful diagrams? This post performed 10x better than my usual LinkedIn content.

The upside of the post was that I got connection requests and inbound DMs from my ICP: agency owners looking to sell. I ended up having a handful of calls with people, some who were starting to contemplate an exit.

I think I will start to mix in agency finance or agency M&A-type content more regularly. This will allow me to more frequently call out that we are actively looking at agencies to acquire. Openly sharing our POV on acquisitions may also build some credibility with potential sellers, especially if the content is educational and answers some questions they may be grappling with.

Finally Driving Some Revenue with AgencyHabits

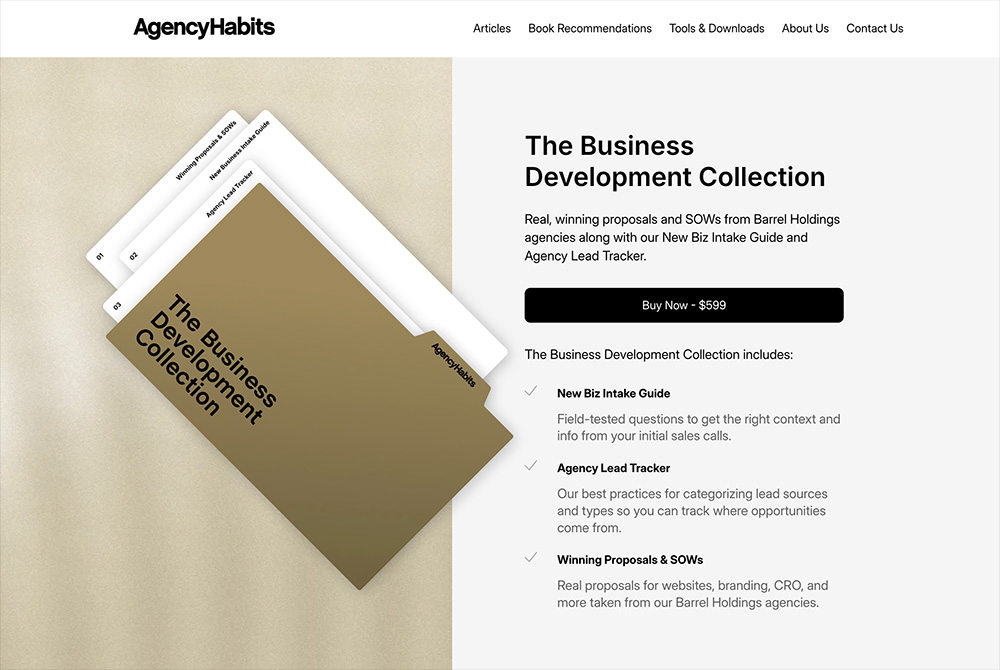

After much delays and lack of prioritization from my end, we were able to launch The Business Development Collection on AgencyHabits, a paid product featuring biz dev guides as well as real proposals and SOWs taken from a few of our Barrel Holdings agencies.

I think at $599, it’s a worthwhile investment if you’re curious about getting a peek at what some of our agencies are doing with their winning proposals. There may be a few things you pick up and start incorporating into your own sales process. Even if you don’t find the collection impressive, it can serve as reassuring confirmation that what you’re doing is just as good if not better. And sometimes, it’s worth spending money for that extra bit of confidence.

We recently launched The Business Development Collection, the first paid product from AgencyHabits.

We’ll continue to add to the collection (more proposals, SOWs, and different types of guides), so customers who’ve bought it early will always have access to the latest version.

We also started monetizing our newsletter. We tested a sponsor for 6 weeks in our weekly edition that goes out every Friday AM. I shared that we had secured our first sponsor on LinkedIn, which led to a few more inbound inquiries. We signed another one to start in early April. We’re keeping pricing fairly low to start as we prove out value for our early sponsors and start building out a real program.

We see AgencyHabits as an important driver of M&A deal flow, potential talent, and leads for our agencies from other agencies. We’re reinvesting all revenue right back into creating better content and web experiences. Right now, it’s a pretty scrappy operation that’s mostly myself and some help from Bolster, but as we grow revenue, I hope to bring someone on to help.

Top of Mind

Learnings & Realizations Via M&A Convos

Sei-Wook and I spent a good chunk of time in Q1 reviewing agencies for sale and meeting with various agency owners, hoping to add to the Barrel Holdings portfolio. Some leads were through our buy-side advisory firm Rainier Associates and others were from our own networks including our resource site AgencyHabits.

We’ve continued to refine our search parameters. As we get exposed to more agencies, we’re becoming more opinionated and forming filters for what we want to pursue and what we want to pass on.

A couple of realizations:

Avoid the Too-Small

We’re better off ignoring agencies that are too small in revenue and profit. These are sub-$1 million agencies with less than $300,000 seller’s discretionary earnings (SDE).

In 90% of the cases, the business is overly reliant on the owner for new business, account management, and subject matter expertise. And these are situations where the owner wants to transition out fairly quickly.

It’s too much risk and a great deal of effort for limited upside. Even at what seems like an attractive multiple (2x) or structure (mostly seller note, earn-out, or commission-based), there’s an opportunity cost to chasing deals like this. Our time could be spent going after larger deals.

The Gap in Valuation

Most of our conversations with agency owners stall out when we get to the topic of valuation. We tend to take a more conservative approach to looking at a company’s P&L. We take into consideration things like revenue growth, client retention, client concentration, and gross margins.

We’ve come across some very aggressive EBITDA add-backs, expenses an agency owner re-classifies as profits with the justification that it wasn’t material to the business. A common example is if an agency owner ran their car payments through the business for tax benefits. Sure, we’ll say okay to adding back $600/month to profits assuming the agency will no longer have to make those payments once bought by us. But we’ll typically push back on EBITDA add-backs if we feel that they were real mistakes in hiring or ineffective marketing investments. On a few occasions, we’ve seen people add back entire salaries for a new business person who didn’t work out. Sorry, but that was a real cost and had the new business person worked out, their cost would’ve surely counted.

Differences of opinion on EBITDA add-backs can widen the gap. Let’s say you think the EBITDA is $500k but the agency owner believes it is $800k. On a 3x multiple, that’s an extra $900,000 in valuation.

The other factor that impacts valuation is the agency owner’s involvement in the business. Do they have a viable successor in the business who can take over and lead the day-to-day? Is there someone already available? Or will someone new need to be hired? Perhaps more than 1 person?

Let’s say the agency shows $600k EBITDA after all the add-backs (called “adjusted EBITDA”) and let’s say we’re good with it. And we know the owner pays themselves $300k in annual salary. So it’s $900k in seller’s discretionary earnings. The owner claims that they barely work in the business anymore, just some administrative work a few hours a week. However, upon closer inspection we find that the owner is still vital to the new business function and nobody else in the business is able to take it over. We estimate that it would cost at least $200k to find a suitable new business person to take over. Our EBITDA that we use for valuation comes in at $700k ($900k SDE minus $200k for the new biz lead) and let’s say we put a 4x on this for a $2.8 million valuation. But the agency owner doesn’t agree. They believe their agency is worth closer to $4.5 million ($900k SDE x 5x multiple).

Maybe there’s a way to meet in the middle or maybe there’s a creative way to structure it, but often times we’re too far apart. And there are also other buyers out there with deeper pockets willing to pay the asking price. Great for the seller, but doesn’t work for us.

Specialization is Key

For a brief moment, we explored the possibility of targeting generalist agencies with a regional focus. These are often run by agency owners getting close to retirement age and looking to transition out. The more we looked at these businesses, the more we came away believing that our focus for Barrel Holdings should be specialized agencies with a focus on a particular tech platform and/or industry vertical. Barrel is a good example, combining its Shopify ecosystem expertise with a deep focus on CPG. BX Studio’s focus on Webflow has also been helpful.

There are some very good agencies offering integrated campaign work (web, social, TV ads, and other activations) and also taking on branding, app builds, and other projects. Their client roster tends to be very diverse and can include restaurant groups, auto dealerships, higher ed institutions, government agencies, law firms, insurance companies, healthcare groups, and more. At scale, you’re talking about big regional and national ad agencies, many of which are successful and some which are consolidating through PE-backed roll-ups. But at the sizes we’re looking at, sub-$5 million in revenue, there’s just too much risk.

Initially, we felt that we could bring on an agency like this and have them offload any branding, UX, or web development work to our other agencies while focusing on strategy, creative, account management, and media buying. But what we observed was that these agencies, some which have been around a very long time (some for 25+ years), are highly reliant on the founder’s network and have very few new business opportunities throughout the year. They typically rely on a handful of long-term clients for the bulk of their revenue and might add a couple new clients to make up for any churn. They have trouble growing and are often at risk of being in serious trouble if one or two of their top clients ever go away.

None of these challenges are new for any type of agency, generalist or specialized. However, for us, we felt that we were in a better position, based on our own experience, to help grow and steward a specialized agency doing a particular thing or serving a particular type of client vs. one doing many things for many types of clients. Even if focused geographically, the prospect of supporting an agency that would soon lose its founder and also without specialization became less appealing to us.

An agency that excites us might be one that’s gone incredibly deep into an industry vertical and is very well connected and visible to those in the industry. They may have a charismatic and impactful owner but the agency itself has enough of a reputation (and a very capable leadership team) that it can continue to attract opportunities once the owner has transitioned out of the business.

Shared Quotes

“When members of a team go to their leader whenever they see a peer deviate from a commitment that was made, they create a perfect environment for distraction and politics. Colleagues start to wonder who ratted them out, they get resentful of one another, and the team leader finds herself being constantly pulled into situations that could be more quickly and productively solved without her.” (Patrick M. Lencioni, The Advantage)

This is a great reminder that a strong culture is one in which people are willing to resolve issues amongst themselves through difficult conversations. I wrote about strong culture vs. weak culture and the behaviors of accountability and autonomy are very important factors.

“This is the true joy in life—that being used for a purpose recognized by yourself as a mighty one. That being a force of nature, instead of a feverish, selfish little clod of ailments and grievances complaining that the world will not devote itself to making you happy. I am of the opinion that my life belongs to the whole community and as long as I live it is my privilege to do for it whatever I can. I want to be thoroughly used up when I die. For the harder I work the more I live. I rejoice in life for its own sake. Life is no brief candle to me. It’s a sort of splendid torch which I’ve got to hold up for the moment and I want to make it burn as brightly as possible before handing it on to future generations.” (Stephen R. Covey, The 7 Habits of Highly Effective People)

Love this perspective and it’s something I think about a lot as I pour my time and energy into building Barrel Holdings. Within the holdco, our collection of agency leaders–our community–continues to grow, and beyond it, so does the community of agency leaders we hope to bring into the fold as well as those finding value through AgencyHabits and sharing experiences with us as peers.