We’re starting to see companies using more and more AI tools to do some of the heavier lifting that agencies like ours would traditionally handle. For example, we noticed that for Catalog, some clients were leveraging Lovable to create their marketing websites using AI prompts. This was work that we used to do, but instead, we were asked to focus only on some app UI work (which, too, could be done using AI for the most part). I’m also sure that in the coming months and years, people will more reliably use a tool like Gamma to do their presentations not to mention using AI features on existing tools to do brand and web designs (e.g. Figma, Canva, Photoshop, etc.).

In the short run, this will eat into some of our revenue, there’s no question about that. However, if we play our cards right and continue to evolve our services, I think we’ll be in a good position. The AI-powered tools are great time and cost-savers for clients, but there’s still the work beforehand of knowing what to create and why. This is an opportunity for our agencies to be more involved in the planning, research, prioritization, and strategy work.

The AI deliverables today are also anywhere between 10-95% good enough. There’s still, no matter how small, a degree of polishing and final touching that will be required via a human. Maybe it gets to 99-100% at some point, but I think the last bit will take a while to fully build away with tech. And even the assurance of “human eyes” to check quality before launch will not fully go away. As long as that need exists, agencies like ours can provide value.

More likely though, I think our agencies will thrive on the fact that the exploding world of AI will require greater expertise in knowing how different tools and systems work with each other. Piecing things together, knowing the right questions to ask, understanding what flows into where and why, and tying these all back to business results – it’s no different than what we’ve done for clients with software, content, design systems, and branding, but now with this powerful technology we call AI.

I’m very optimistic about the future. Yes, there are uncertainties, and yes, we may experience some difficulties at times, but I think our energies are better spent thinking about and experimenting with possibilities vs. being preoccupied by fear.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

HoldCo Conference

Sei-Wook and I attended the HoldCo Conference at the Sundance Mountain Resort in Utah. We met dozens of very impressive and smart entrepreneurs. Some were early in their holding company journey, still operating their first business day-to-day but starting to look at M&A possibilities. Others were much further along, having built up programmatic M&A processes and combined dozens of businesses into 9-figure annual revenue empires.

Sei-Wook and I attended the HoldCo Conference at the Sundance Mountain Resort in Utah.

We’re less than a year into operating our holding company on a full-time basis and while we’ve learned a great deal thus far, there’s still so much we’ve yet to understand and experience. Being around people who are tackling challenges that we’ve yet to see and hearing stories of various acquisitions gone right and wrong, we picked up a lot of very useful information over the few days.

Two key takeaways for me were:

- There are many ways to structure and build a successful holding company. Some were classic roll-up plays backed by private equity investors targeting a specific fragmented market, others were a seemingly random mix of businesses bought opportunistically, a few were a collection of vertically integrated businesses, and others opted to build a portfolio of franchise businesses. Even the size of businesses people went after and the manner in which they financed their acquisitions varied widely. Some holding companies only opted to start businesses from scratch while others did a mix. The beauty of capitalism is that people can get really creative with how to make money. We saw that on full display.

- Execution is everything. A lot of the stories we heard had very little if at all to do with innovation and everything with execution. Buying 50+ $1 million businesses over the course of a few years and efficiently improving each of their operations; organically growing winners in a portfolio for over a decade and attracting high-multiple offers; building a massive audience through content & leveraging the audience to drive new business and get quality M&A deal flow – none of these are groundbreaking approaches but they require focus and a very high level of execution for a long time. If you follow certain people on social media, it might sound like anyone could just buy a bunch of businesses and find success. The playbook isn’t what’s special, it’s the actual ability to follow through and drive results that separate the hopefuls from those who build something significant.

Quarterly Leadership Summit

We convened for our Barrel Holdings Quarterly Leadership Summit. Five of the 7 agencies were present in-person in NYC. One of them was SuperFriendly, our most recent agency that we acquired/launched in early March.

We kicked off with a brief review of Q1 with the agencies reporting their revenue and profit numbers as well as new business activity. We recorded record aggregate revenue and profits for Barrel Holdings. BX Studio had a huge revenue quarter and Barrel had an amazing profit quarter. Catalog posted improved numbers. Overall, things seemed to be headed in the right direction across the agencies and everyone was working very hard to acquire new clients and expand existing client relationships.

Left, some of our agency leaders chatting after our session. Right, our post-session dinner.

SuperFriendly CEO Jon Sukarangsan gave an intro presentation to SuperFriendly, covering the agency’s ICP, services offering, and go-to-market. I could see that the other agency leaders were very impressed by the tightness of the presentation and some took inspiration and applied tweaks to their own agency decks later.

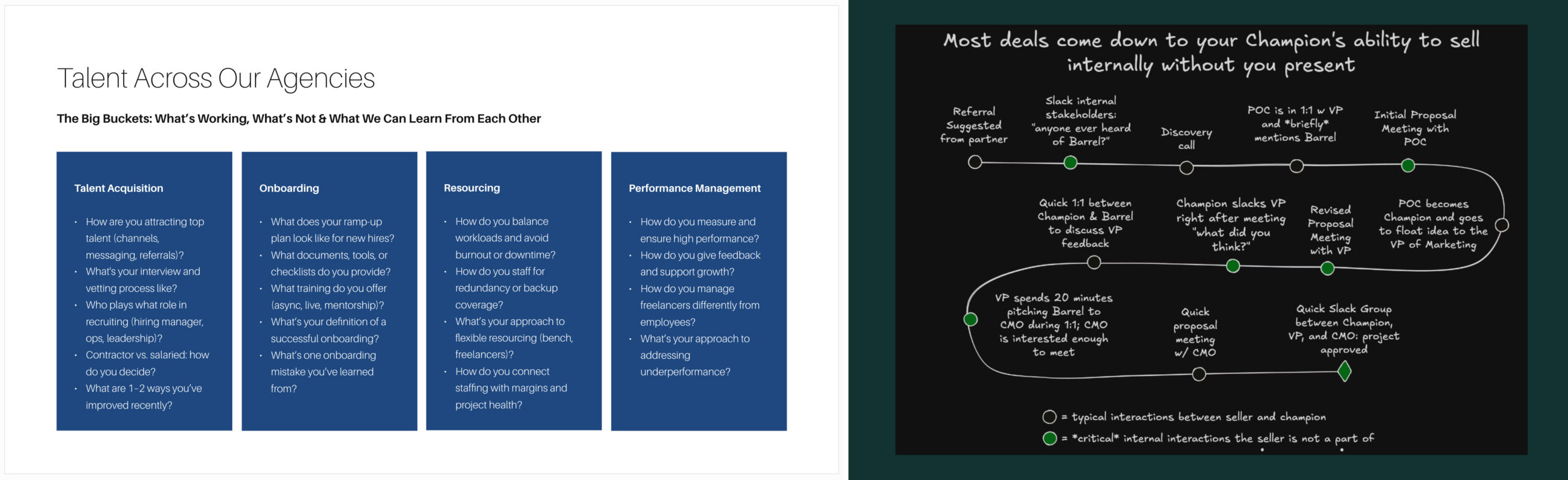

We also had a productive session discussing various topics around talent. The agency leaders shared their approaches to recruiting talent ranging from posting on LinkedIn, getting referrals from ecosystem partners, or leveraging recruiters. We also talked about ways to efficiently vet talent through test projects and part-time recruiters.

Left, some thought-starters for our knowledge share discussion on talent. Right, a slide from Luke Maloney’s presentation on sales.

We ended the day with a session led by Luke Maloney, who has been coaching several of our agencies on B2B sales over the past quarter. He shared some really helpful concepts that’s been foundational to his coaching: the idea that most deals come down to your champion’s ability to sell internally without you present and having the right mindset to do sales.

It was really great to hear from those who’ve felt truly transformed by Luke’s coaching. Catalog CEO Fitch Li talked about how his entire approach to sales shifted and how he’s gotten so much more confident through working with Luke. Quetta Haythorn, Bolster’s Studio Manager, also talked about how Bolster’s sales process improved and how she’s been able to connect more effectively with prospects.

After the meeting, those in NYC headed out to a newly opened pizzeria for dinner. It was a great time.

This was perhaps our last “quarterly” leadership summit. Moving forward, we’ll be switching it up and doing these twice a year. With 7 agencies and only more to come, Sei-Wook and I will have separate quarterly meetings with each agency to do more in-depth quarterly planning work. The semiannual leadership summits will be around more leadership development content and knowledge share, perhaps expanding to a multi-day event.

Deal Under LOI

Earlier in the month, we signed a letter of intent with an agency after coming to terms on an offer. We’re aiming to close in 60 or so days and thick in the middle of due diligence and getting bank financing. Most likely won’t write about this again until June, wish us luck.

In the meantime, we’re continuing to have conversations with prospective sellers and looking at deals each week.

Top of Mind

“Compensation is Our Way of Speaking to Employees”

“The two operations I’ve recently agreed to buy, we will have rational compensation plans. … I think it’s been a huge advantage at GEICO to have a plan that is far more rational than the one that preceded it. And I think that advantage will do nothing but grow stronger over time because, in effect, compensation is our way of speaking to employees. And with a place as large as GEICO, you can’t speak to them all directly. But it speaks to them all the time. It says what we think the rational measurement of productivity and performance in the business is. And over time, that gets absorbed by thousands and thousands of people. It’s the best way to get them to buy into their goals….

“It’s silly to think that somebody working very hard at some very small job at Berkshire, with our aggregate market value of $90 billion, is going to move the stock. But their efforts may very well move the number of policyholders we gain or the satisfaction of policyholders. And if we can find ways to pay them based on that, we are far more in sync with what they can do—and they know it makes more sense. So, I hope our competitors do all kinds of crazy things on comp and everything else. The more dumb things they do, the better life is for us. We’ve had incredible success at keeping managers. I don’t think there’s any company in the U.S. of size that has had better luck on that than Berkshire. And partly, it’s because we appreciate, in terms of the compensation plan and generally, managers that do a terrific job for us.” – Warren Buffett (Buffett and Munger Unscripted by Alex Morris)

Compensation is something Sei-Wook and I talk a lot about when it comes to Barrel Holdings. With each of our agencies, we have to ensure that we have the right compensation plan in place for our agency leaders. What behaviors do we want to see and what compensation structure will reward them appropriately?

We also talk to each of our agency leaders about their respective comp plans for their employees. Similar to us, they are asking what structures are appropriate for reinforcing desired behaviors. We talk about salary bands, raises, and comp reviews. We also end up talking about the role of spot and annual bonuses and how they should be managed.

I love Buffett’s framing of compensation as a “way of speaking to employees” and signaling what we want the employees to absorb.

At the Barrel Holdings level, we care very much about cash flow and profits because they drive our core strategy of fueling acquisitions and compounding over the long-term. Therefore, our agency leaders are heavily incentivized through profit sharing. They are less likely to spend mindlessly or for show. They are more likely to ask themselves: will this expense help increase profits in the long run?

We do not reward directly for revenue growth, but our agency leaders know that unless revenues are at a certain level, no amount of profit margin will yield enough absolute-dollar profits. As a result, revenue gets baked into the profit incentive.

At the agency level, our agency leaders have to think about the ways in which team members impact the business and align incentives so they are more inclined to do the things that move the agency in the right direction. Is it quality? Is it getting projects done on time? Is it client satisfaction and retention? Is it converting new leads? Is it driving new leads? Different roles have different outcomes and you can also find results where everyone plays a part.

We’ve found that it’s very easy to overcomplicate compensation systems and incentive programs. In some situations, it’s actually better to just keep things simple. For example, just designating a certain percent of net profit to bonuses and distributing them to the team once a year is simple and doesn’t require much explanation. It’s also less likely to stay top of mind for employees, so the motivating factor you hoped for may never materialize.

If an agency does opt to do a more tailored compensation and incentive approach, it’ll require clear alignment on metrics that are reliably tracked and legible to everyone. Whether that’s related to new business metrics like deals won or client retention metrics like account growth dollars, success of the plan depends on how accurately the numbers are tracked. For many smaller or less operationally sophisticated agencies, this is a tall order.

Where it gets harder is when the metrics are less quantitative and more qualitative. Best to avoid these if possible, but tracking around quality, sentiment, and external validation (e.g. awards, certifications, press coverage) need clear lines drawn to business impact. Are you willing to reward your People Ops leader for scoring high on employee sentiment about working at your agency or for winning a “Best Place to Work” award? How will you know if these things contributed to revenue and profits? I’m not saying it’s impossible, it just requires you to think it through carefully in advance.

I also believe it’s not an all-or-nothing approach. You can have tailored incentive programs for some employees, especially if they’re in roles like sales or account management where they have a direct role in driving revenue. And then for others, you can opt to keep it super simple (e.g. cost of living adjustments annually, salary bands by role, and discretionary bonuses handed out by department leads based on company’s overall profits & department’s proportional take).

There are other aspects of compensation that we’ll need to dig into more. These include phantom stock/equity considerations for agency employees, especially the leaderships teams, as they scale and have the opportunity to exit. While Barrel Holdings is designed for long-term holds and compounding of cash flows, you never know when an eager buyer may come around and convince us to sell. In which case, you’d want to have a proper incentive plan to help retain the leadership team through the transaction and beyond.

And then there’s the stock plan for Barrel Holdings itself. Sei-Wook and I have been sketching out various stock plan details and mechanics. We feel that we are properly incentivizing our agency leaders with the profit sharing plans at the agency level. They also have phantom stock in the event the agency sells. However, because we know that the majority of our agencies may be long-term holds that never see an exit, we’d love to offer our agency leaders the opportunity to experience the upside of Barrel Holdings while operating within the portfolio.

We’re leaning towards the Constellation Software (CSI) model of allowing execs to buy stock in the holding company. No stock options, no discounts, but just at fair market value. CSI is a public company, so anyone can buy their stock, but they’ve done some interesting things in requiring their business unit leaders to buy stock with a significant part of their bonuses and hold it for the long term. Barrel Holdings, because it is private, will operate differently and access to our stock will be very limited. However, if done right, I think it can be another avenue through which our agency leaders can benefit from being part of our portfolio while being incentivized to continue generating cash that can be sent to HQ.

Shared Quotes

“Bonding within the organization takes place as one individual and then another steps up and raises his or her level of commitment, sacrifice, and performance. They demand and expect a lot of one another. That’s extremely important because when you know that your peers—the others in the organization—demand and expect a lot out of you and you, in turn, out of them, that’s when the sky’s the limit.” (Bill Walsh, Steve Jamison, Craig Walsh, The Score Takes Care of Itself)

We’ve been talking about this a lot across all of our agencies. The importance of having high standards both for yourself and for your team is such a huge driver of whether or not a culture will be highly performant.

“Great leaders ask great questions. They know that if they come up with all the answers, the chances of having anyone else buy into the solution are next to zero. But if their employees come up with the answer—if they feel ownership of it—there is a good chance it will bear fruit. Telling, commanding, and stating the truth as you see it will not engage or empower. Answers make you feel like a leader, but questions create real followers.” (Andrew Sobel and Jerold Panas, Power Questions)

It’s tempting to think along the lines of “if we transmit this information to our team, they will become more knowledgeable and therefore more effective”, but there’s often a big gap between knowledge transmission and knowledge absorption. This is where asking good questions, having people share their understanding of a situation, and collaborative brainstorming become necessary tools for training and knowledge expansion. In general, people tend to learn so much quicker when they feel that they’ve figured it out or made the connection on their own. If you don’t care to take credit for teaching others, all the better, let people feel like they did it on their own, it’s stickier this way.