In this troubling and uncertain climate, I thought it would be a good time to review my personal finance stack head on and to share some of the moves I’m making.

Like most others, there’s been a great deal of pain seeing my investment portfolio take some big hits. However, there’s opportunity to do some discounted buying in the coming weeks which may pay off in the long run. Then again, as a small business owner, there will be some uncertainty around my income, especially as the overall economic conditions deteriorate. It’s an uneasy time but I’m overall optimistic that things will work out.

My Holdings

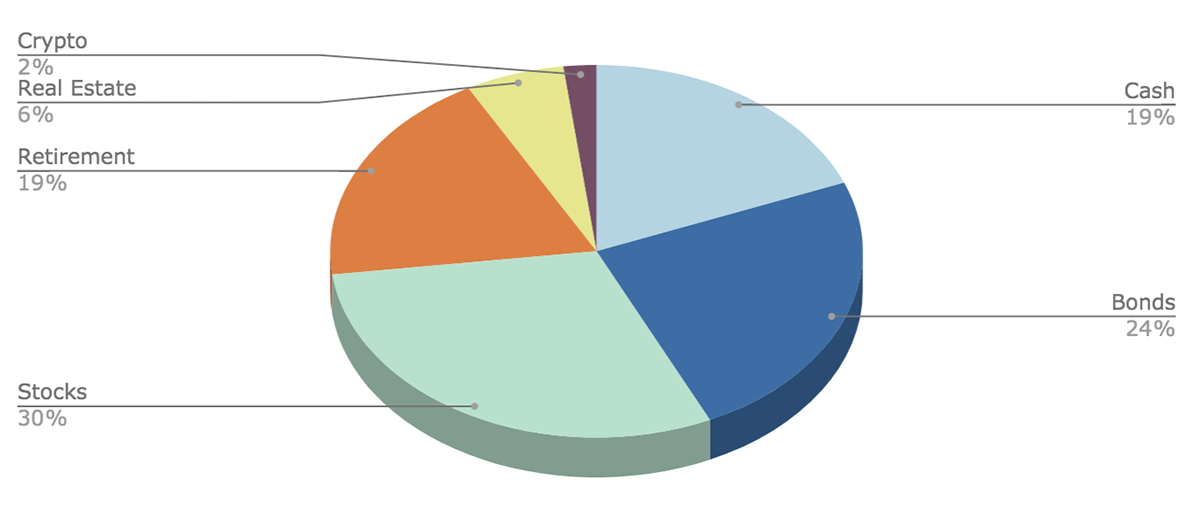

This is a rough breakdown of my current holdings. I’ve excluded our primary residence and my parents’ place from this. I’ve also excluded any angel investments and real estate partnership investments just to keep it simpler. These also excludes the value of my stake in Barrel as a business.

I use Personal Capital (disclosure: referral link) to track these holdings. The total includes checking and savings accounts that I share with my wife as well as our shared Vanguard investment account. It does not include her own bank account and her own retirement account. I’ve also excluded our son’s 529 plan which we’ve been contributing to for over a year now.

These percentages are as of March 19, 2020 – with the volatility of the market, these could shift a few percentage points here and there in the coming days and weeks and may look much different a month from now.

As a point of reference, the value of my holdings decreased by almost 20% in a period of 3-4 weeks from its peak on February 23, 2020 until March 19, 2020.

|

As of March 19, 2020

|

|

|

Cash

|

19%

|

|

Bonds

|

24%

|

|

Stocks (single stocks, index funds)

|

30%

|

|

Retirement (mostly stocks)

|

19%

|

|

Real Estate (REITs, Fundrise)

|

6%

|

|

Crypto (mainly Bitcoin)

|

2%

|

Here’s a 3D pie chart view of the same data:

I’ll be jumping into each of these asset buckets and share what I’ve been doing and what I plan on doing in the coming weeks and months. Before I do that, I wanted to share the main sources of income and the primary expenses that shape my cash flow.

Main Sources of Income

My primary source of income remains Barrel. 2019 was a great year for Barrel and as a result, the profit distributions and bi-weekly pay added up to the most I’ve ever made in a single year. However, with the coronavirus crisis this year, we are navigating challenges at Barrel which means I’ll be taking a significant hit in pay. It’s possible that my comp stays at or near zero for at least a few months in 2020.

Luckily, Mel and I are sitting on a decent amount of cash to see us through. A big part of that came after we sold our condo in January. Instead of investing everything, I decided to keep a good chunk in cash for peace of mind. That was a lucky move given the circumstances these days.

I suspect that my dividend income from stocks, which was already on the decline in recent years because of my shift to tech stocks and index funds, will be even less as companies slash their dividend distributions due to the impact of coronavirus. In 2019, the total amount of dividend income from stocks was slightly over $5,000, much less than in previous years.

One thing that will add to our income this year is dividend payments from our bond holdings. As I’ll share in the Bonds section, I picked up some bond funds in early February with our condo money. While the value of these holdings have been suffering, they should still generate a UBI level of income for us each month.

Primary Expenses

2019 marked a very big change for our family. We moved to a new place in August 2019 and along with it, we now have a sizable mortgage, HOA fees, and property taxes to pay each month. The days of putting away 60+% of my monthly income are long gone.

We now have two monthly mortgages: our new home and and my parents’ co-op in Sunset Park. These two are, by far, our biggest expenses and dwarf any of the other living costs.

I tried to refinance my parents’ co-op recently but with the recent spike in mortgage rates, I withdrew my application and will try again when things calm down.

The other thing to note about primary expenses is that since our baby was born in early 2019, we’ve cut back significantly on eating out and ordering in. We went from dining at restaurants 1-2 times a week to once a month and takeout went from 3-4 times a week to at most once a week. We’ve taken to cooking much more at home and while the grocery bill has gone up quite a bit, it’s still less than what we used to spend going out or ordering in.

If my income level falls, it’s quite possible that we may have to dip into our cash savings to keep up with our expenses. Thankfully, my wife has a job, albeit more challenging than ever, without much risk of income loss (NYC Department of Education high school principal).

We’ll have to be smart about discretionary expenses in the coming months.

Bonds

In February, I bought some significant positions (by our standards) in a few bond funds to diversify our stock-heavy portfolio using some of the proceeds from the sale of our condo. I split them evenly across three funds:

- Vanguard High-Yield Corporate Fund Admiral Shares (VWEAX)

- Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWALX)

- Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares (VWIUX)

As you may guess, the high-yield corporate fund is faring the worst while the two muni bond funds have fared the best (although still losing some value) during the crisis.

I don’t regret these purchases and I’ve set the dividends to reinvest, so there will be some dollar cost averaging over time. It’s impossible to time the market, so rather than panic sell, I’m going to leave these assets alone and forget about them for a while.

Stocks

At the same time as I bought the bonds, I bought a decent chunk in the S&P 500 (Vanguard’s VFIAX) right as it was nearing its peak. It’s been a precipitous decline since then, almost a 26% drawdown as of March 19 and likely more losses to come.

I also bought a smaller position in Vanguard’s small cap index fund (VSMAX), which has seen more than 38% of its value evaporate. Ouch.

Unfortunate timing on my end for both of these, but oh well.

During this time, I’ve decided to continue to leave my automatic investments on even if it’ll mean digging a bit into my cash savings. If things still look very dire in 30-45 days, I may put a pause on these, but for the moment, I want to buy when prices keep dropping.

Note: If I didn’t have at least 1 year’s worth of cash savings, I probably would have turned off all automatic investments. That’s about the threshold I would have for feeling okay about investing at a time like this.

These automatic investments go into:

- My family Vanguard brokerage account that mostly goes into the small cap index fund (as I’m overly exposed to large cap stock) with some going into the bond funds mentioned in the previous section.

- My Fidelity brokerage account where it goes into Fidelity’s no-fee index fund FZROX.

- My Motif brokerage account (disclosure: referral link) where it goes into a “Digital Dollars” motif that contains 20 companies ranging from PayPay to Square to Visa that are all players in cashless payments. These guys have taken quite a pounding as well in recent weeks but I think they’ll still be very much relevant and growing after this crisis.

- My Acorns account (disclosure: referral link) where I’m still putting away a $5/day plus “round-ups” from my credit card charges. This portfolio has also suffered as it mostly mirrors the S&P 500, but no sense in stopping now.

During this time, my stock holdings will continue to grow in number of shares. The value might be greatly diminished right now, but as I’m generally bullish about the economy long-term (10-20+ years), I think it’s worthwhile to keep buying as long as I’m being smart about having cash on hand for living expenses and emergencies.

There may be moments in the coming months where I also add some single stock picks if the prices look good and I have strong long-term conviction. But I think this will largely depend on the health of my own business and ensuring I’m back at or close to my pre-crisis income levels.

One more bit about stocks: I did time one thing pretty nicely. On February 4, 2020, I sold the few shares of TSLA in my portfolio at $883.76. I found myself swayed more and more by the $TSLAQ community on Twitter that pointed at Tesla’s accounting trickery and its shaky business situation. When the stock popped and inched towards $1,000, I felt I should exit out of my small position and just pocket the gains. Having bought the shares at an average cost basis of around $300, it was a nice win that was quickly forgotten weeks later when the carnage began.

Retirement

I have three retirement accounts:

- One is a 401k account tied to Barrel with a minimal balance that hasn’t been contributed to in a few years. I intend to just leave this alone in the target date fund I selected and forget about it. It’ll be a nice little bonus in 20+ years.

- I have a Roth IRA that I stopped contributing to some years ago after I became ineligible. It’s split across a few large cap index funds.

- My SEP-IRA (SEP stands for Simplified Employee Pension) is my largest retirement savings account. Just before the crisis, I actually got a lump sum contribution for 2019. I sat on the cash and bought FZROX after an especially bad day in the market. I still have half in cash ready to deploy in the coming weeks as I’m really hoping the market outlook rebounds as we gain more certainty around coronavirus and the resulting fallout.

I’m not active with my retirement holdings at all. I just pick and hold and keep it simple with index funds. I have some FANG (Facebook, Apple, Netflix, and Google) positions from some years ago, but I stopped doing single stocks in my retirement portfolio. With these, the approach is a simple “set it and forget it”.

Real Estate

I’m in a few partnerships with friends in multi-family units in West Philadelphia. We were able to sell one of the properties last summer after a few years at a tidy profit. We were hoping to offload one more property this Spring but coronavirus dampened the market overnight.

Not counting these partnerships in this overview of holdings, I’ve invested in the following:

- Vanguard Real Estate Index Fund (VGSLX) which invests in real estate investment trusts (REITs) and is thus exposed to a range of commercial and residential properties. This holding has taken quite a beating during the crisis especially as hotels and commercial properties suffer from quarantines and loss of business. Soon, residential properties will be in trouble as many people begin missing out on rent payments. It’s going to take a long time for this fund to recover.

- Fundrise (disclosure: referral link), the real estate investment platform, represents a much smaller position for me. I wrote about how the platform works in 2019. I’ve scaled down my monthly investment to $250, much less than what I was putting in throughout 2019. It’s hard to say how these guys will perform during the downturn as well since they report on only a quarterly basis and isn’t tracked like a publicly traded REIT. In a letter about investing during the coronavirus outbreak, they wrote the following:

…we’ve been specifically building the broader Fundrise portfolio with the intention of being able to sustain a prolonged period of economic distress as a result of this kind of eventuality.Today, nearly 70% of the portfolio is held in residential rental properties, the vast majority of which are focused on providing well-located and reasonably priced housing to workforce renters. We’ve weighted toward these types of assets because they generally have better withstood past economic downturns; shelter, like food, is a basic need rather than a discretionary expense.I hope they’re right.

Crypto

I wrote in 2019 that investing in crypto felt like pure speculation and that I had largely stopped doing it. With the world going haywire and the price of Bitcoin–supposedly uncorrelated–also taking a nosedive, I decided to buy some on a whim.

First, I did it by converted my other crypto holdings–XRP, ETH, and LTC–into BTC using the Coinbase app (disclosure: referral link). This got me 30 million Satoshi, or 0.3 BTC. I also bought a few decent-sized chunks with fiat currency. I currently have auto-investments set up for every 2 weeks for a couple hundred bucks just to slightly increase my exposure.

With the Federal government doing all kinds of money printing and injections into the economy during this time, I’m a bit concerned about what impact this will have on the dollar in the long run. Will there be runaway inflation? Will trust in the value of the dollar be diminished? I hope not. Buying some Bitcoin is just a tiny hedge.

That’s The Rundown

This is the current state of affairs when it comes to my personal finance stack. Between the time I’ve written this, to the time I’ve posted it, to the time you’ve come across it, I’m sure there will have been quite a bit of market movement. It’s a volatile time.

In the short-term, I’m worried and anxious about many things: keeping my business above water, staying safe and healthy with my family, wishing for the safety and health of friends and relatives, and hoping this country can turn the tide of this virus and regain a sense of normalcy.

In the long run, I’m optimistic. I think we’ll get through this although at great cost, and there will be new opportunities and growth that emerge from the struggle. I feel incredibly lucky that I’m in a position to even write a post like this. It wasn’t the greatest feeling in the world to see the red numbers plastered all over my screen, but I’m fortunate to have accumulated these assets at all and blessed that my family is in a relatively stable situation.

To anyone who comes across this, my best wishes on your health, wealth, and happiness during these trying times.

Hi, if you have a stock watchlist that you can share, that might be interesting. Take care

Hey Julien, https://www.peterkang.com/stock-investing/ has an up-to-date snapshot of a couple of my portfolios and a link to my stock watchlist. Thanks!