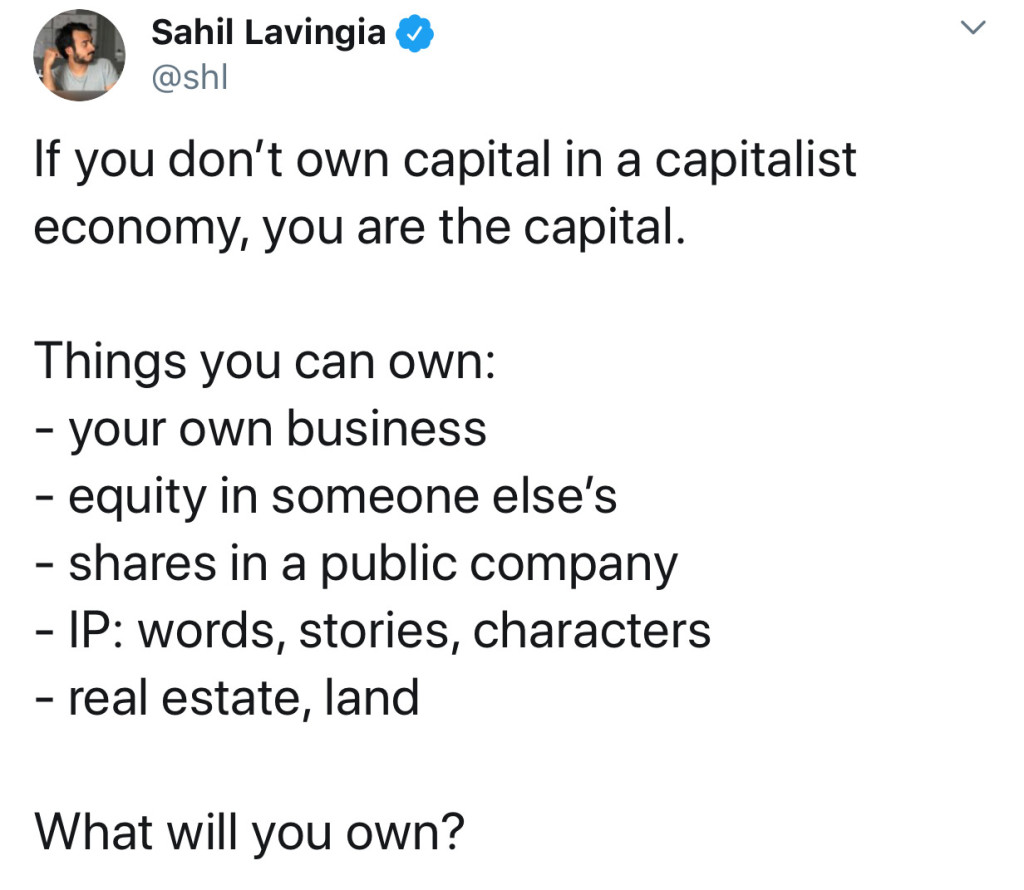

I came across this tweet by Gumroad founder Sahil Lavingia:

Check out original tweet here.

Lavingia’s epic post “Reflecting on My Failure to Build a Billion-Dollar Company” on his founder’s journey is worth reading. He also openly shares the progress of the business in both a public dashboard and in tweets like this, always fascinating to see as a business owner.

I wanted to save his tweet about owning capital in a capitalist economy because it made me think about where I am now and where I’d like to be as I continue to play this game.

Before I start, it’s worth noting that this capitalist game is just a part of life and not the end all be all. Being good at this game can provide financial stability and a few less things to worry about, but happiness is not guaranteed. I’d argue that health, relationships, and a sound mind (e.g. ability for introspection, having perspective, being content, clarity of thought, etc.) are more important.

With that, the capitalist game, if you begin to understand the rules and get some lucky breaks, can be a fun one. I wanted to go through each of the above and take stock of where I’ve been able to own capital and where I have some opportunities.

One more thing: as a follow up to this tweet, Lavingia also added that “audience” was also another form of capital, which I’ve included below.

Also, full disclosure: I put in some affiliate links here and there wherever I mention services I currently use or subscribe to.

Your Own Business

I’ve been lucky to own my own business, Barrel, in an official capacity since 2006. It’s the largest source of my income and also the most valuable thing I have an ownership stake in. I prize the fact that the business can run without my daily involvement and that the business has seen consecutive years of growth. Of course, there’s still so much to be done and I feel like we’re still only 20-25% of the way towards establishing a rock-solid system and honing our positioning. But I’m super grateful that my co-founder Sei-Wook and I stayed persistent and grew Barrel to what it is today. It’s basically enabled all the other forms of capital that follow.

Equity in Someone Else’s Business

Through the connections I’ve made via Barrel (clients, prospects, industry folks, etc.), I’ve been privy to some private market deals that have allowed me to gain ownership in someone else’s business. These include early stage tech startups and consumer packaged goods (CPG) brands as well as some later stage companies where early employees have taken money off the table by selling their shares. None of these so far have hit the jackpot and many are still pre-exit, but it’s been a great education to learn about the different types of deals (e.g. SAFE, convertible notes, RSUs, etc.) and what to look for when evaluating the potential of a business. In some cases, I’m able to advise founders and help them in ways that I hope will grow their business.

I have to note that this is not the safest way to invest capital, but I’ve found it to be rewarding while fully understanding the risk that I may walk away with zero dollars.

Shares in a Public Company

I love reading about the public markets and while I’ve mostly shifted to buying index funds, I still make the occasional single-stock purchase for fun. My biggest winners of the past decade have been Amazon, Apple, Shopify, Walmart, Facebook, and Netflix. They make up the big bulk of my unrealized gains. I unloaded a good chunk of my Facebook stock earlier this year to free up some cash for my mortgage down payment.

Even if my single-stock investments have slowed, I still like reading about the businesses I’m invested in as well as any other businesses and sectors I should care about. I’m also always down to read anything about Warren Buffett’s Berkshire Hathaway (I own a few shares of their Class B stock) and what public company stock they’ve bought and sold (e.g. they own a ton of Apple stock) and also what they’re looking to do with their huge pile of cash (over $100 billion). In fact, reading every one of Buffett’s annual shareholder letters was a really great primer for investing and I highly recommend it.

It’s worthwhile to learn about public companies and how they work. Daily newsletters like Finimize and Morning Brew have made it more accessible than ever and with brokerages now charging zero commission on trades, there’s no reason not to invest. Despite all the poo-pooing we hear these days about corporations and big business, there’s something very American about being able to own a piece of these successful enterprises and sharing the fruits of their growth. For example, I feel fortunate that I ponied up just under $3,000 back in 2014 to grab 9 shares of Amazon. They’re worth a lot more today, and I have no plans on selling them anytime soon. Even if it’s just a fractional share (some brokerages, like Robinhood, allow you to buy $10 worth of a $500 stock), you’re still getting a piece of the business and you can add more over time.

One more thing about owning shares in a public company: I’m not suggesting that everyone become stock day traders. And I’m certainly not giving any investment advice here. What I’m suggesting is that it’s worth learning more about different public companies and considering buying companies that you really believe in (and can hold for a long time) or buying into an index fund that reflects the performance of an index like the S&P 500.

IP: Words, Stories, and Characters

I’m envious of creative folks who own intellectual property (IP) such as published short stories, novels, songs, screenplays, movies, and artwork. Not only must it be very satisfying to put out work that others can enjoy and relate to, these works can become very valuable. Think about Disney and its immense economic advantage thanks to its ownership of IP across its various iconic characters (Mickey & friends) and franchises (e.g. Marvel Cinematic Universe, Star Wars, etc.).

I’ve always told myself that I’ll publish a book or two in my lifetime, and I feel more motivated than ever to give it a real go. I am grateful that I have this blog and some other words written online that have been valuable in building my credibility and connecting me with cool and interesting people (more on this under Audience).

Real Estate, Land

I’ve significantly expanded my real estate holdings in the past few years. I teamed up with my buddies to invest in a handful of multi-unit properties in West Philly which produce income from the rent. I’ve put some money into Fundrise, the crowdfunded real estate platform that invests in various residential and commercial properties in the United States. And then there are two Brooklyn properties that my wife and I own, the co-op where my parents live and our new apartment in South Slope.

I believe I’m in the second inning of my real estate investment game. I plan on putting in the time to become a more sophisticated real estate investor and expect to invest in more properties in the coming years. I also love the idea of saving up to one day buy a nice family vacation home or to get one built (I’ve been inspired from watching The World’s Most Extraordinary Homes on Netflix).

Audience

I see audience as a form of capital in a few different ways. I don’t have the type of audience that a celebrity or influencer has through a massive following on social media, but it’s possible to get a lot of value from a much more niche audience. Audience value comes from being able to push out news and ideas to a receptive audience, to get feedback that helps improve my work, to connect with new people in meaningful ways (e.g. they relate to something I’ve read and want to share their story and also get to know me more), and to promote something I’m offering as a product or service.

I have a lot of work to do in this arena as well. At Barrel, we value our marketing email list, which we use to update current and former clients and acquaintances about our most recent work. These reminders are valuable in keeping us top of mind and spurring folks to reach back out to us every now and then for new work. I do think we have opportunities to engage with our Barrel audience in more meaningful ways like offering engaging events and more thought leadership content that may be helpful.

I have my own email list via this website, a few hundred people strong, that I’ve tried to cultivate with weekly link curations and CTAs to my own blog posts. While small, this experiment has been near and dear to me, allowing me to stay connected to good friends and people I greatly respect and admire. I have zero expectations of monetary value here, but the relationships and opportunities that come out of my audience is totally worth it.

Lucky to Play the Game

I feel lucky to be having fun playing this game. In many ways, starting Barrel at a young age really set me on the path to be open to other types of businesses, investments, and creative activities. I sometimes wonder if I would be as active in learning and experimenting if I didn’t own my own business, the reason being that I’m constantly trying to find a new way or edge for the company.

I appreciate that this is also an infinite game. Unlike a finite game that starts and ends with pre-determined rules, this capitalist economy game is never-ending and has fluid rules, players, and outcomes. There will be times when my business or investments struggle mightily and there will be times they flourish beyond imagination, but understanding that the true privilege is in continuing to play the game will help me learn from my mistakes, gain greater perspective, and appreciate the dynamism of capitalism.