I spent a cloudy Saturday afternoon analyzing the stocks in my various brokerage accounts and decided to emerge with a clearer idea of my investment approach moving forward along with some “spring cleaning” to-dos that will consolidate my portfolio.

A Bit of a Mess

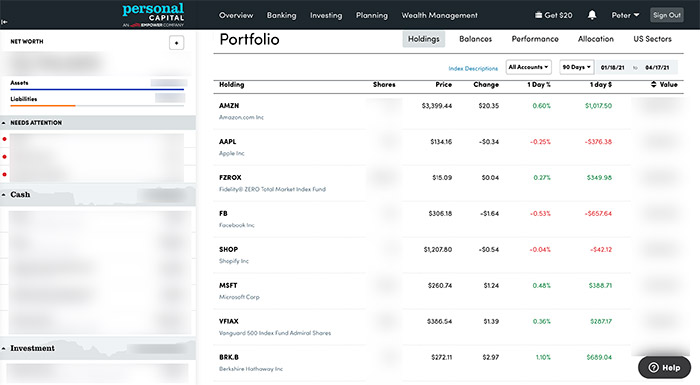

The best way to view my portfolio was to use Personal Capital (disclosure: referral link), which pulls in all my portfolio info from across all my investment accounts, and open up the Investing > Holdings section. Unfortunately, there is no export function, so I copied the page into Google Sheets and used the Query function to organize the data into neat rows and columns.

A screenshot from Personal Capital, which I used to get a consolidated view of all my investments across various brokerage accounts.

I separated out all of my mutual funds and ETFs from the list. These investments added up to about 16.5% of my portfolio. I have auto-investments still happening each month across a Vanguard S&P 500 index fund (VFIAX) and a Vanguard Small Cap index fund (VSMAX).

I counted a total of 98 single stock positions. 97 if you count GOOG and GOOGL as pretty much the same. I then broke it down to see how concentrated my portfolio was. Here’s what I found:

- Top 5 positions: 38.05% (AMZN, AAPL, FB, SHOP, MSFT)

- Top 10 positions: 53.12%

- Top 15 positions: 63.29%

- Top 20 positions: 71.36%

- Top 25 positions: 78.06%

- Top 30 positions: 83.26%

- Top 40 positions: 90.64%

- Top 50 positions: 95.24%

Beyond the Top 50, I have 47 positions that amount to less than 5% of the portfolio. I ran through each one and identified at least 33 positions I want to exit and re-allocate. I made the determination based on my level of knowledge about the companies as well as level of conviction in their long-term prospects. For many, I simply did not know enough and also was unlikely to spend the time to take a deeper look. Better to re-allocate the funds to stocks I know and feel stronger about.

Of the remaining 14 positions I decided to keep, a few are long-term holds that I would like to consider more seriously and potentially increase in position size in the future. These include Dollar General, Roku, Salesforce, Match Group, and Alibaba. With Salesforce, I expect that position to grow once the Slack acquisition goes through. I may add more on my own as well.

I ran the same exercise for my Top 50 positions and found 1 position I definitely wanted to exit: Hims. I had bought this as a FOMO buy with friends when it was a SPAC and was never really enthusiastic about the business (direct-to-consumer health products with a telemedicine angle). I’m happy to realize a modest gain (low teens) and re-allocate the funds elsewhere.

Exploring a New Investment Approach

Moving forward, I’d like to try the following 4-part approach to bring some order and discipline to my investing approach:

Part 1: Develop the Framework

Having an investment framework will help me be disciplined about what to look for and what qualities I value in a business. I’ve started a rough first draft of one under my Stock Investing section.

My initial thought is to describe the qualities of “compounders” – companies that generate great cash flow and can grow above market returns steadily over time. I want my portfolio to primarily be composed of compounders with durability and opportunities for massive value creation over a 10+ year period. I was inspired by a pretty good framework that I found on the website of the Compounder Fund:

- Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market.

- Strong balance sheets with minimal or reasonable levels of debt.

- Management teams with integrity, capability, and an innovative mindset.

- Revenue streams that are recurring in nature, either through contracts or customer-behavior.

- A proven ability to grow.

- A high likelihood of generating a strong and growing stream of free cash flow in the future.

Another part of the investment framework I will feature is a section on “When to Exit” and what flags will clue me into thinking about selling my position. My hope is to be a long-term holder, but it’s very possible that a business that was once strong loses its footing and becomes a shell of itself. You can see my initial list also in the Stock Investing section.

Part 2: Build a Deliberate List Through Research

Using the framework, my goal is to initially build a list of 10 companies that I think have a chance to grow tenfold (10x) over the next 10 years (25.9% annualized returns). I’ll be looking to dive deeper beyond the usual articles and podcasts to build my case around these companies. I’ve so far enjoyed using Koyfin to look into the financials. My research will look to properly assess the attributes in my investment framework.

I have a feeling that some of these companies are already in my portfolio, but I’ll be glad to do deeper analyses on them and in the process, hone my investing skills and understanding of business.

Part 3: Build Larger Positions in High Conviction Picks

As my list comes together, I will start buying aggressively, allocating any spare cash I can across the list. In the next few years, I expect my high conviction picks (around 10-15 positions) to make up 90% of my single stock portfolio. These may include a few that I already have sizable positions in and hopefully some newcomers that I’ll identify in my research.

Part 4: Monitor Annually

I won’t have the bandwidth to closely follow my list or every position in my portfolio each quarter. But I don’t think this will be a bad thing. I will plan to set aside some time once a year to review all of my positions (much like I did with this “spring cleaning”) and re-assess the list. I will lean towards inaction and patience because if I do my picking right, time is the greatest advantage I have in getting my portfolio to grow.

Investing as Liberal Art

I’ve enjoyed investing because it’s been a great way to expand my knowledge about businesses, consumer behavior, markets, macro-economics, technology, government, and a host of other topics. I like reading about the history of industries, entrepreneurs, and nations that shaped the markets we know today. I also like messing around with spreadsheets and looking at the financials of companies to see how they’re performing.

I recently started a book called Investing: The Last Liberal Art by Robert G. Hagstrom, which is inspired by Charlie Munger’s view of applying worldly wisdom to investing and how building a “latticework of mental models” can help us make better investing decisions. It dives into subjects like physics, mathematics, philosophy, biology, etc. to identify mental models that have been applied to investing. I see investing as a two-way street–the things I learn while investing will help me better understand certain things I come across in operating my business and in my personal life; and, to the book’s point, I hope to bring my varied experiences and knowledge in other subjects to my investment decisions.

All in all, I’ve come to see investing as a wonderful way to keep on learning all while enjoying the game mechanics of gains and losses and high-stakes decision-making. I’ve also structured our family’s finances so that these investments are immaterial to our day-to-day quality of life. Therefore, I see investing not as a desire to make a lot of money, but instead, an activity to keep me curious and intellectually engaged.